The Pros and Cons of Taking a TSP Loan for Federal Employees

One advantage of the TSP or 410k plan over an IRA is the ability to borrow against the funds. A credit check is not required, and the loan can be accessed relatively quickly. However, is that a good idea? What are the hidden costs of taking a TSP Loan? This article will shed light on TSP loans, their advantages and disadvantages, and how to decide if one is right for you.

What Are the Basics of a Thrift Savings Plan (TSP) Loan?

A TSP loan allows you to borrow against your vested contributions and earnings. You cannot borrow based on the agency matching contributions or the automatic 1% contribution. You repay the loan with interest through payroll deductions or by paying off the loan by making direct payments.

Understanding the TSP Loan Process

The process is fairly easy and can be done on TSP.gov or by calling Thriftline Services. However, there are several eligibility requirements

- Must be an active employee. Retiree or separated employees are not eligible

- Have at least $1,000 of your contribution in the TSP, not including any money in the mutual fund window

- If you have an existing loan, it must be in Pay status, meaning that you are current on loan payments

- Have not paid off a TSP loan within the past 30 days

Interest Rate and Repayment Terms of a TSP Loan

The interest rate of the TSP is based on the G Fund’s interest rate in the prior month. The current interest rate is 4.375% (April 2024). TSP will notify your payroll office and start payroll deduction based on the repayment period you selected. However, it is your responsibility to ensure payments start within 60 days.

Knowledge is Confidence!

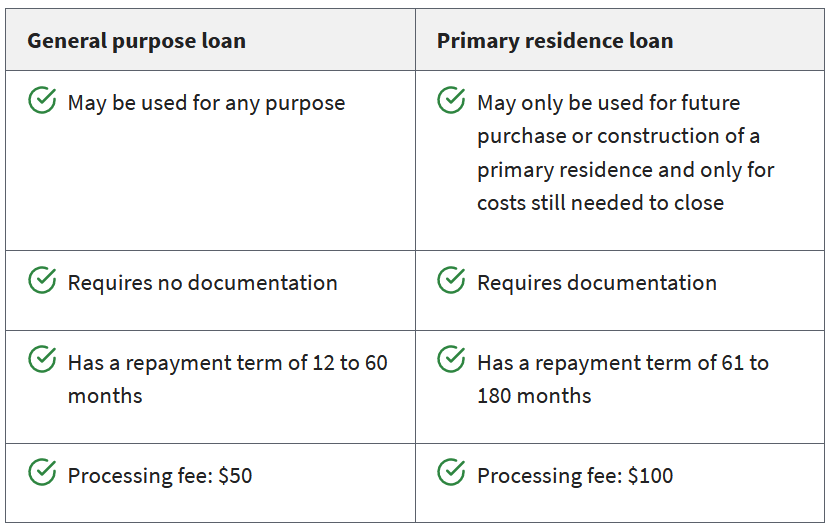

Types of TSP Loans: General Purpose vs. Residential

There are two different loan types available: general purpose and residential. You can utilize both at the same time if necessary, but you can only have one loan per loan type. If you have a civilian and military TSP, you can take loans in each account separately. The limit on the amount you can borrow is the same for general purposes and residential loans.

- The minimum loan amount is $1,000

- The maximum loan amount is limited to the lowest amount based on factors below

- Your own contribution and earnings, less any outstanding loan balance

- 50% of your account balance based on contributions and earnings or $10,000, whichever is greater after it’s been offset by any outstanding loan balance

- $50,000 minus your highest outstanding loan balance within the last 12 months. Even if the loan has been paid, the balance would still be used if it was open within the last 12 months.

General Purpose TSP Loan

As the name indicates, the general loan can be used for any purpose and requires no documentation. You can select to pay it back between 1~5 years, and the processing fee is only $50.

Residential TSP Loan

The residential loan is limited to the purchase of your primary residence. Moreover, you cannot use the loan to reimburse yourself for the purchase. For regular home purchases, you must provide all pages of the signed sales agreement, purchase contract, or settlement offer. If any information on the agreement or contract has changed (like the closing date), you must submit an addendum to reflect the change. If you are building a new residence, you need to provide a signed copy of the builder’s contract or building permits if you are building the home yourself.

The repayment period can be from 5 to 15 years, much longer than the general purpose loan. However, the processing fee is $100, double that of the general purpose.

Which Type of Loan is Best for Your Financial Goals?

The type depends on your time frame and need. In general, if you plan to purchase a home, I suggest you go through the documentation requirements to get a residential loan. The longer repayment period means lower per pay-period payments so you can manage your monthly budget. In the event of an emergency, you can still access funds by using a general purpose loan. Lastly, you can always pay off the loan earlier. There are no prepayment penalties or fees.

Pros of Taking Out a TSP Loan

There are some advantages to the TSP Loan compared to other loan and withdrawal options. The biggest one is that it requires no credit check and no loan underwriting. You can get access to the fund pretty quickly. Moreover, since it is a loan from your TSP account, it is not taxable. If you withdraw from the TSP, you will face income tax and other penalties depending on your age.

Interest Rates and Advantages Over Other Loan Types (Home Equity Loan or Unsecured Personal Loan)

Other than the advantages listed above, the TSP Loan’s interest rate is much lower than that of personal loans or home equity loans. That is because the rate for the TSP loan is based on the G Fund’s previous month’s interest rate. With the G Fund’s average 10 year percentage at 2.35%, it is a low-cost option.

Flexibility in Using a TSP Loan for Various Financial Needs

This is the advantage of the general purpose loan. I have spoken to younger professionals who use it to purchase a car since they are still establishing credit. Others have used it to bridge a short-term income gap that they can pay back quickly. I have also seen people use it when they are buying and selling real estate at the same time and need short-term cash. They pay off the loan after the property has been sold.

My biggest caution is using the TSP Loan to consolidate and pay down credit card debt. You need to understand the reason why the credit card balance built up and make plans to address the issue. After you pay off the credit cards, you need to stop using them to make sure your budget can balance. Too often, I speak to people who use their TSP to pay off credit cards only to see the card balances build up again.

Cons of Taking a TSP Loan

The main goal of the TSP is to build up your retirement savings, not provide a low-interest loan.

There are several cons on why you should not take a loan in the first place. When you take a loan, the TSP will move the balance out of your investment funds and set it aside as collateral. While the money is in this status, it is not invested and does not earn any interest. That means you could miss out on years of compound interest and returns. Another downside is that there are some tax deficiencies with the loan payments. Assuming that the loan comes out of the Traditional TSP, it is tax deferred and taxable at retirement distributions. You are paying for the TSP loan & interest using after tax dollars from your paycheck. While the original loan balance was not taxed, the interest you are paying will face double taxation.

Repayment Challenges and Potential for Default at Separation or Retirement

If you separate or retire from federal service with a loan balance, you must set up a payment plan or pay off the loan balance. If you do not, the loan would be considered default, and the entire loan balance would be taxable that same year. If you are under 59 1/2, you would also pay the 10% tax penalty on top of income tax. Lastly, although the TSP will coordinate loan payments with your payroll office, it is your responsibility to ensure the payment amount is correct and timely.

Should You Take Out a TSP Loan? Weighing the Pros and Cons

Before you decide on what to do, it is certainly worth the time to reach out to a financial planner to understand your options. There are certainly long-term considerations you should be aware of. What assumptions can you make about the missed investment opportunity? When can you pay back the loan? More importantly, how will the loan help your current financial situation and 5 years from now?

Evaluating the Financial Impact of a TSP Loan on Your Future

You need to weigh the opportunity cost of the investment against the benefits of the loan. Often, you may see better returns in the TSP, especially over a long period. If you are a diversified investor, you could reasonably expect 6~8% return over time. If you take out $10,000 for 5 years, you could miss out between $3,382 ~ $4,693 in earnings. If you borrow more, the amount would only be greater.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.