Social Security

& Related Posts

Social Security Considerations

Social Security is the cornerstone for many American’s retirement and financial security. Yet, for many, it remains a complex system shrouded in mystery. Will it be there when I retire? How much will I receive? These are just a few questions that swirl around this vital program. The articles and information on this page are the beginning of navigating the world of Social Security. If you have a unique situation or have questions, we encourage you to reach out and schedule a time for personalized guidance. Our team of advisors can help address common concerns and misconceptions, empowering you to make informed decisions about your future.

Eligibility for Social Security

To be eligible to collect Social Security, you must have 40 quarters of coverage. Since there are 4 quarters each year, you could be eligible to collect Social Security from working 10 years. However, keep in mind that there’s also a small income requirement. In 2024, you must make over $1,730 to earn 1 quarter of coverage. To earn all 4 quarters, that means your annual income has to be at least $6,920. This income request is adjusted each year and can be found on ssa.gov.

How is the Benefit Amount Determined?

Social Security uses a formula that considers the age when you start collecting, your birthday, your income history, and the index for inflation. While most of these numbers are out of our control, the one we can keep track of is our earnings history.

Social Security uses the highest 35 years of income to determine your Average Indexed Monthly Earnings (AIME), the basis for all Social Security benefit calculations. It is up to us to ensure your earning history is correct. While Social Security will correct any errors found, they will only do so if it’s reported within about 3 years. The best thing to do is create your ssa.gov login and verify your earning history around tax season. If you see errors, you can also notify them online. Correct Social Security Earnings

Social Security FRA (Full Retirement Age)

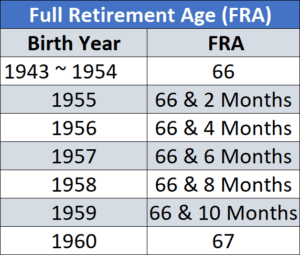

One of the biggest factors that determines your Social Security amount is the year of your birth. Social Security used that year to determine how old you need to be before you are eligible for your full benefit.

As you can see, anyone born after 1960 will reach their full retirement age at 67. This is important not only in how much you will receive but also in how much will decrease if you started collecting before 67 or if you waited to collect after 67. Keep in mind that FRA is only what Social Security has decided is your full retirement age. While you can certainly retire whenever you want, the amount you collect will be affected.

How Does Age Affect My Social Security Benefit

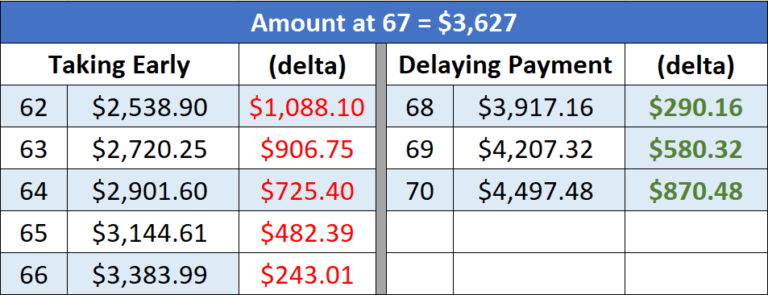

Social Security allows anyone over age 62 to start collecting their benefit. However, there is a reduction or penalty because you are collecting earlier. If you are still working or don’t need the income, you can wait to collect your benefit, letting it grow beyond your FRA. Social Security will increase the benefit amount until you reach age 70. The chart below shows a hypothetical benefit amount. Assuming that your FRA is 67 and the benefit amount is $3,627, here’s your benefit amount if you started early or waited.

The Earnings Test (Don’t Take Social Security Early If You Are Working)

If you are over 62 and looking for additional ways to supplement your work income, you do not want to use Social Security for that purpose. Social Security has an earnings test to discourage working individuals from taking Social Security before their FRA, meaning that if your work income exceeds the threshold, you will lose your Social Security amount. For 2024, the earning limit is $22,320 and goes up yearly by inflation.

Cost of Living Adjustments

Social Security benefits increase yearly according to the announced cost of living adjustment (COLA). While we saw historical increases in 2021 and 2022, the 10-year average COLA is 2.75%. While any increase in income is important, retirees need to consider if COLA reflects actual inflation and plan to fill gaps in expenses and income.

Reference: ssa.gov

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.