FERS Survivor Benefits

& Related Posts

FERS Survivor Benefits & Options

The complexities of planning for retirement can be daunting for federal employees, particularly when it comes to understanding survivor benefits under the Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS). Whether you are a current federal employee under CSRS or FERS, a retired federal worker, or a surviving spouse or family member, knowing how survivor benefits work is crucial for retirement planning and ensuring financial security. This article sheds light on the vital aspects of CSRS and FERS survivor benefits, delineating key differences, integration with Social Security, eligibility criteria, the nature of benefits payable, and how life changes like remarriage or re-employment might affect these benefits.

What are the Key Differences Between CSRS and FERS Survivor Benefits?

Comparing CSRS and FERS Survivor Annuity Options

The Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS) both offer survivor benefits, but with notable distinctions. Under CSRS, a survivor annuity benefit is generally more substantial, reflecting the system’s structure without integrating Social Security benefits. In contrast, FERS is designed with Social Security as a foundational component, affecting both the structure and amount of the survivor annuity. Federal employees covered by FERS can elect a survivor annuity for their spouse that significantly impacts their retirement benefits. This election is crucial for planning as it defines the monthly benefit a surviving spouse receives.

Benefit Payable Under CSRS & Cost

The benefit payable under CSRS can be as high as 55% of the gross annuity amount or as low as $1 a year.

The cost for the maximum survivor benefit of 55% is about ~10%. The forumala used to compute survivor benefit cost is as follows:

- 2.5% x up to $3,600 (PLUS)

- 10% of the amount over $3,600

Let’s use an example with an estimated CSRS pension amount of $50,000/year. You would like to leave the maximum 55% survivor benefit.

- 2.5% x $3,600 = $90

- 10% x $46,400 = $4,640

- Total cost = $4,730/year

The CSRS pension would be reduced to $45,270/year or $3,772/month for the retired annuitant. If the annuitant predeceases their spouse he/she would receive 55% of the gross annuity amount which would be $27,500/year or $2,291/month.

Let’s look at an example of leaving less than the max survivor benefit amount. The estimated pension amount is $50,000/year and you wish to leave $15,000/year or $1,250/month to your spouse.

- 2.5% x $3,600 = $90

- 10% x $23,672 = $2,367

- Total cost = $2,457

Benefit Payable Under FERS and Cost

The benefit payable under FERS can be 50%, 25%, or zero.

The cost for each benefit is as follows:

- 50% = 10% of gross pension amount

- 25% = 5% of gross pension amount

- 0% = no cost

For example, if a FERS annuitant is receiving a $50,000/year pension.

- $50,000 x 10% = $5,000

The FERS pension would be redcued to $45,000/year or $3,750/month. If the annuitant predeceases their spouse he/she would receive 50% of the gross annuity which would be $25,000/year or $2,083/month.

Adjusting Survivor Benefits for Cost of Living Adjustments (COLA)

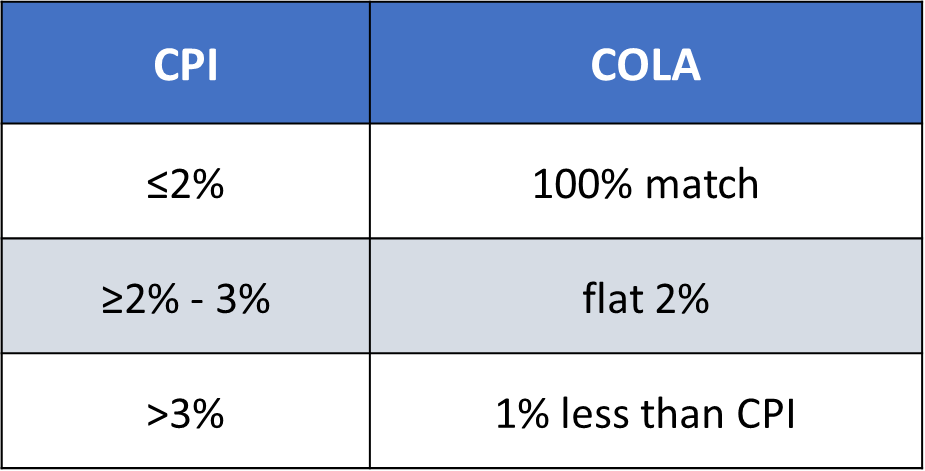

Survivor benefits under CSRS and FERS are subject to adjustments for cost of living allowances (COLA), ensuring that monthly benefits maintain their value over time. These COLA increases reflect the recognition of changing economic conditions, providing an annual benefit increase that helps preserve the purchasing power of survivor benefits. The COLA differs for CSRS vs. FERS. CSRS receives a 100% COLA matched with the Consumer Price Index (CPI-W) while FERS follows a different formula.

FERS COLA formula:

CSRS Survivor Benefits in the Event of Death While Working

Spouse – CSRS or CSRS-Offset

If the employee died while covered under CSRS or CSRS-Offset, recurring monthly payments may be made to the surviving spouse if the deceased employee completed at least 18 months of civilian service. The following requirements apply to the spouse:

- Married at least 9 months

- The 9-month requirement does not apply if the death was accidental, or there is a child born of the marriage

Survivor benefit payments and FEHB will begin immediately. The survivor benefit is calculated as follows:

- 55% of the amount the deceased employee would receive had he/she retired at the time of death

- OR the lesser of: 22% of deceased employee’s high-3 OR 55% of the amount your annuity would had been if you continued working until age 60 at the same high-3

A spouse’s survivor annuity will begin immediately and will end at the surivor’s death or remarries before age 55.

FERS Survivor Benefits in the Event of Death While Working

Spouse – FERS

If the employee died while covered under FERS, recurring monthly payments may be made to the surviving spouse if the deceased employee completed at least 10 years of creditable service (18 months of which must be civilian service). The following requirements apply to the spouse:

- Married at least 9 months

- The 9-month requirement does not apply if the death was accidental, or there is a child born of the marriage

Survivor benefit payments and FEHB will begin immediately. The survivor benefit is equal to 50% of the deceased federal employee’s annuity. The calculation is based on the years of service and high-3 without a reduction for age.

Former Spouse

A survivor annuity may be paid in whole or in part to a former spouse if a court-ordered entitlement to a survivor is on file at OPM.

Insurable Interest

A survivor annuity may be paid to a person with insurable interest, however, FEHB is unable to be maintained if the person of insurable interest is not on the federal employee’s FEHB.

Learn more about insurable interest survivor benefits here.

Children

The government will not award children’s survivor benefits automatically. The surviving parent or guardian must complete an Application for Death Benefits. For CSRS, form SF-2800 which you can find here. For FERS, form SF-3104 which you can find here.

A benefit may be payable to the child of an employee if the child is:

- An unmarried dependent up to age 18

- An unmarried dependent from age 18 to age 22 if attending an accredited educational institution full-time

- Unmarried disabled dependent children may receive recurring monthly benefits if the disability occurred before age 18

A “child” includes an adopted child, stepchild, or recognized child born out of wedlock

The combined benefit of all the children is reduced by the total amount of child’s insurance benefits that are payable (or would, upon proper application, be payable) under Title II of the Social Security Act for the same month to all children of the deceased (including those of a former marriage who may not be living with the current spouse) based on the total earnings of the deceased. In many cases, the FERS children’s benefit is reduced to $0.

Additional Benefits in the Event of Death While Working

Basic Employee Death Benefit (FERS only)

The BEDB is a lump sum death benefit payment made to the surviving spouse of a married FERS employee who dies while in federal service. If no survivor annuity is payable upon the employee/former employee’s death, a lump sum may be payable of the unpaid balance of retirement contributions made by the employee.

The spouse may be eligible for the Basic Employee Death Benefit, which is equal to 50% of the employee‘s final salary or average salary if higher, plus a lump sum of $40,300, adjusted for inflation annually.

Lump-Sum Benefit (CSRS, CSRS-Offset, FERS)

If no survivor annuity is payable upon the employee/former employee’s death, a lump sum may be payable of the unpaid balance of retirement contributions made by the employee. This lump sum is payable under the order of precedence.

What Happens in the Event of Death Before Deferred or Postponed Annuity Begins

Death Before Deferred Annuity Received

Generally, the employee who receives a deferred annuity will not receive FEHB in retirement. As a result, the spouse will not receive FEHB. There may be an exception through the FEHB spouse equity provisions which you can check out here.

Death Before Postponed Annuity Received

The spouse or survivor annuitant is eligible for FEHB when their survivor annuity begins. This applies to federal employees who have postponed their annuity at MRA+10 and have met the 5-year rule. There may be a waiting period of when FEHB coverage begins depending on the commencement of the annuity. The survivor annuitant will need to file form RI92-19 to begin the pension and activate FEHB. You can find form RI92-19 here.

FEHB Coverage as a Survivor Annuitant: Continuing FEHB

Did you know that a surviving spouse can be removed from FEHB if the federal annuitant predeceases him/her? Proper planning and knowledge of your federal benefits can prevent this huge mistake. If a CSRS, CSRS-Offset, or FERS retired annuitant does not elect a survivor benefit the spouse and family will be removed from the Federal Employee Health Benefits (FEHB).

CSRS or CSRS-Offset will only have to elect as little as 55% of $22, which results in a $1 per month survivor annuity. However, FERS is more costly. A FERS retired annuitant will have to elect either a 50% or 25% survivor benefit for the family to maintain FEHB in the event he/she predeceases the family.

Impact of Social Security on CSRS, CSRS Offset, and FERS Survivor Benefits

For CSRS Offset employees, Social Security benefits partially offset their CSRS annuity, impacting the survivor benefit structure. In contrast, FERS incorporates Social Security survivor benefits directly, leading to a dual benefit scenario for surviving spouses. This integration with Social Security under FERS means that the retired federal employee’s election to provide a survivor annuity will not only guarantee a federal retirement system benefit but also secure the survivor’s eligibility for Social Security survivor benefits, under certain conditions.

Learn more about Understanding CSRS Offset and the Windfall Elimination Provision

Learn more about The Impact of Government Pension Offset on Your Retirement Benefits

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.