TSP & Investing

Related Posts

The Thrift Savings Plan (TSP)

The TSP is a retirement savings plan for federal employees and members of the uniformed services in the United States. It offers tax advantages and various investment options to help you save for your future.

Tax Advantages

The TSP offers several tax advantages:

Tax Deferred Growth

All contribution made to the TSP grows tax deferred. That means you do not need to report dividends received on your taxes

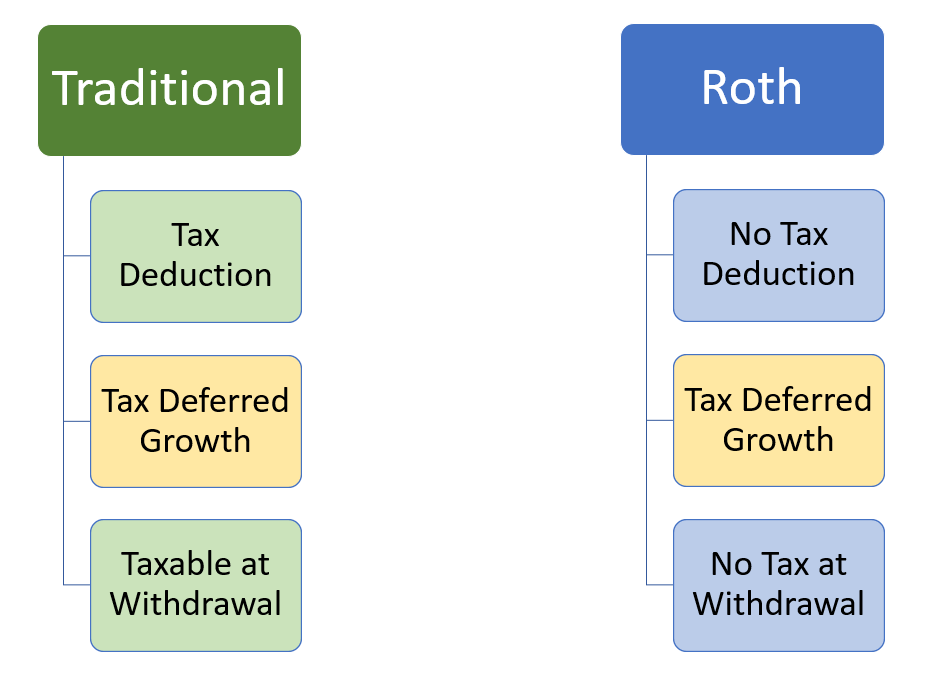

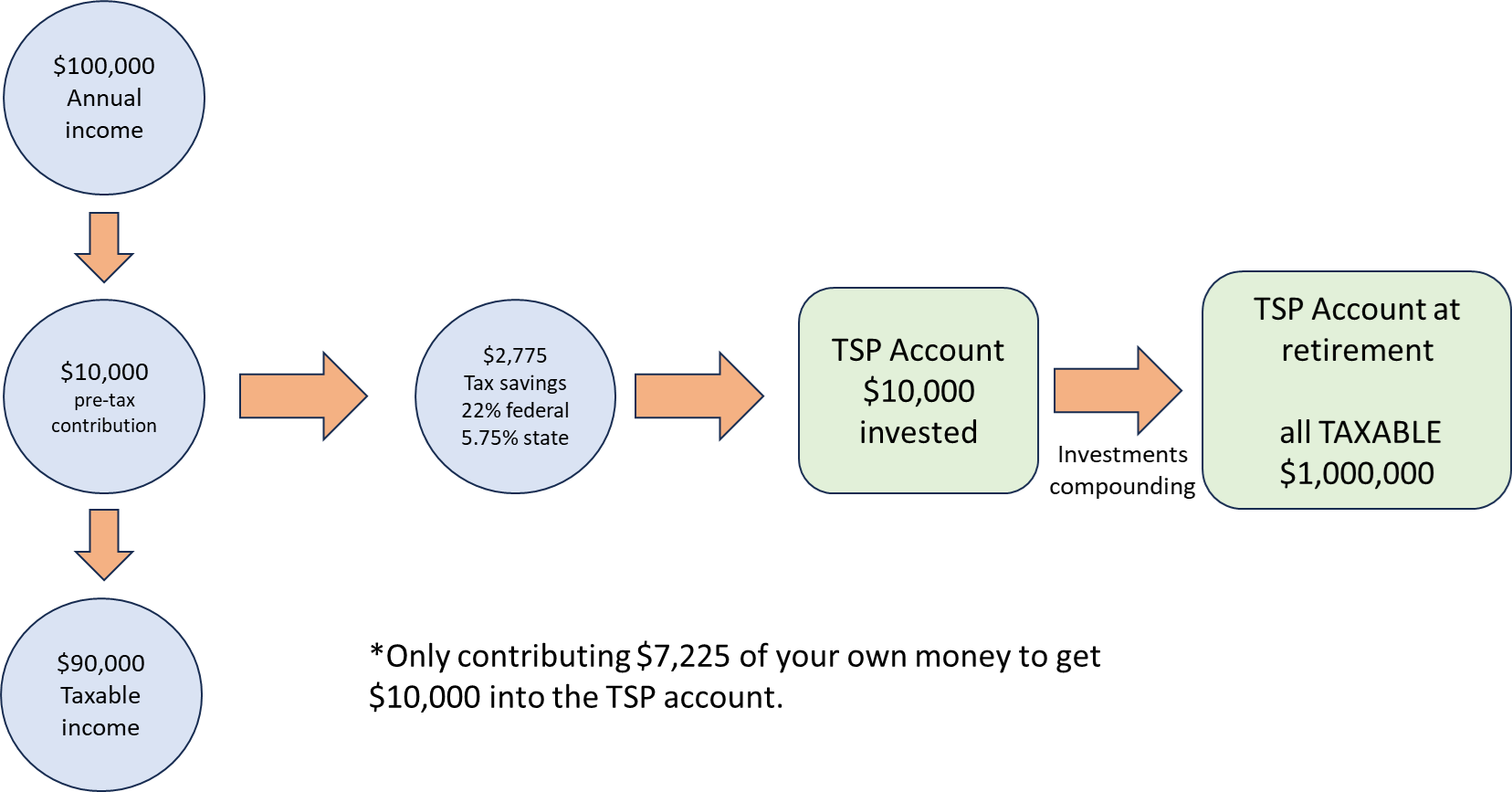

Traditional Contribution

If you are in a high-income tax bracket, you can lower your taxable income by making Traditional contributions. The amounts made will lower your taxable income. After age 59.5, you can withdraw funds from the TSP and pay taxes at that time.

Roth Contribution

While you cannot reduce your income with Roth contributions, distributions after 59.5 are tax-free, as long as you have the Roth account for over 5 years. Tax-free withdrawal also extends to any gains made in the Roth TSP.

Difference Between Traditional TSP and Roth TSP?

Traditional TSP contributions receive a tax deduction immediately on federal and state taxes. Traditional is also known as a pre-tax contribution. Both the cost-basis and investment growth are 100% taxable at retirement. Most federal employees will not be in a lower tax bracket at retirement and should consider doing Roth TSP.

Roth TSP contributions are contributed with after-tax money and do not receive a tax deduction for federal and state taxes, however all of the investment growth is tax-free at retirement.

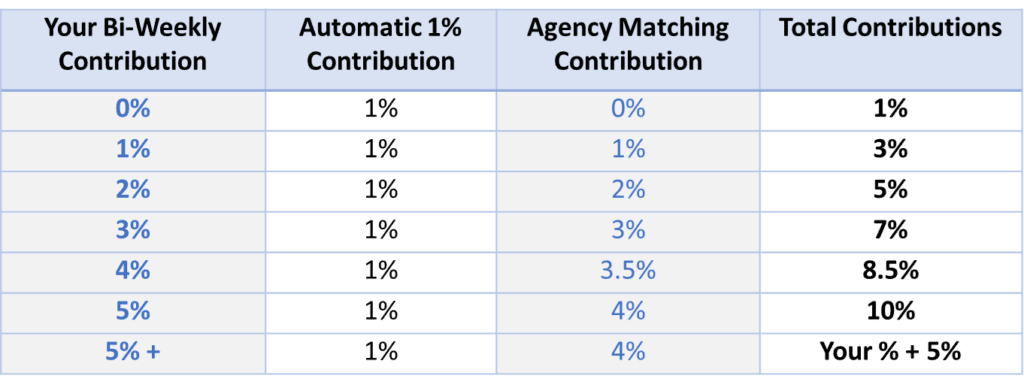

What is the TSP match?

Federal employees receive an automatic 1% government contribution regardless of your contribution amount. You can contribute nothing and still receive a 1% contribution. In addition, federal employees receive a 4% government match based on the employee’s contribution amount. If a federal employee contributes at least 5% you will receive an additional 4% government matching contribution for a total of 5%.

Common misconception!

Contributing the max into the Roth TSP will result in losing the 5% government match. At least 5% must be going to traditional TSP to receive the match.

You may contribute the max into Roth TSP and still receive the 5% TSP match. The government will not place your match into Roth. 100% of the government match goes into traditional TSP.

Annual Contribution Limits

There is a maximum amount you can contribute into TSP per year.

- $23,000 (2024)

- $7,500 if over age 50 (2024)

Do Not Max Out to Soon

If you are maxing out TSP contributions, make sure you are not meeting the maximum contribution limit too early in the year or it can result in missing the TSP match. Make sure to take the maximum amount of $23,000 or $30,500 and divide it over the amount of pay periods you receive for the year. For example, if you were to max out by June 1st you would miss out on half the years 2% match which can result in the loss of thousands of dollars in matching.

If you are on 26 pay periods:

- $884 per pay period for $23,000

- $1,173 per pay period for $30,500

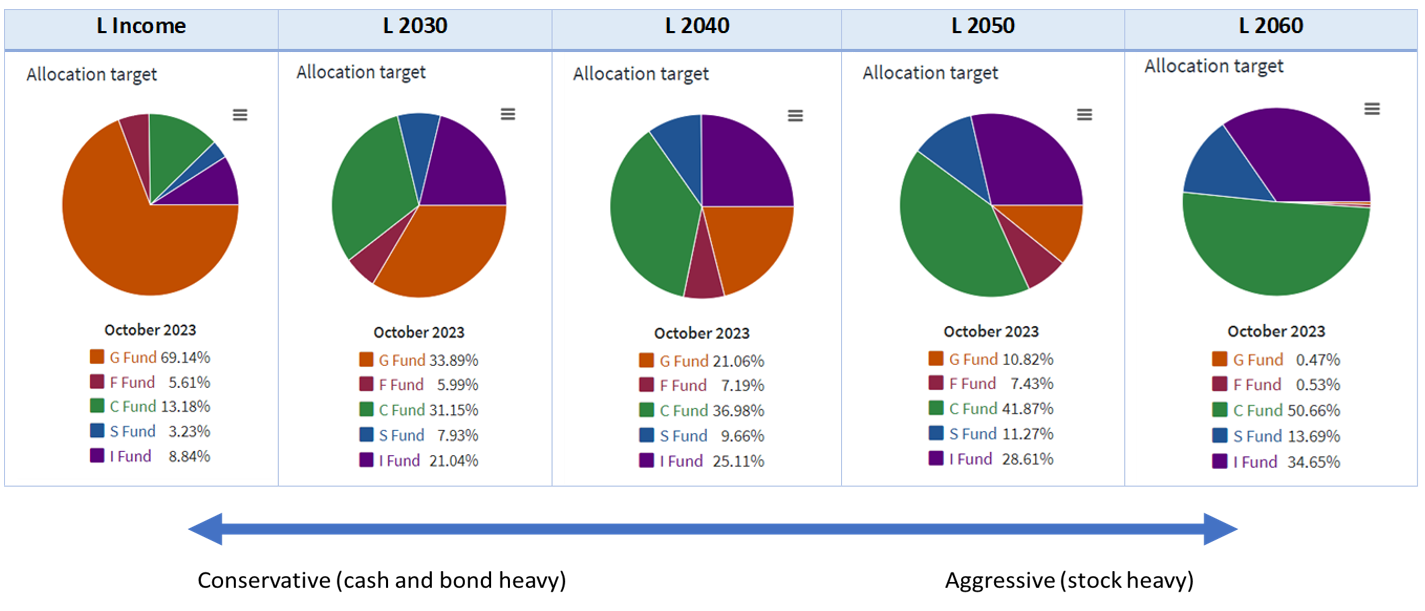

Investment Options: The 5 Investment Fund

The L Funds

The Mutual Fund Window

If you would like to go beyond the 5 investment funds and L funds, you can now use the Mutual Fund Window and access over 4000 funds in the private sector. However, fees and limitations apply. You can learn more about it here Inside Look at the TSP Mutual Fund Window – PlanWell Financial Planning (planwellfp.com)

Sources: The Thrift Savings Plan (TSP.gov)

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.