FERS

& Related Posts

Understanding the Federal Employee Retirement System

The information below is meant to be a short summary. For a more comprehensive explanation, we suggest reading our Complete Guide to FERS – Federal Employee Retirement System.

Congress created the Federal Employees Retirement System (FERS) in 1986, and it became effective on January 1, 1987.

The Federal Employees Retirement System (FERS) is a retirement plan for federal employees in the United States. It was established in 1987 to replace the older Civil Service Retirement System (CSRS). FERS is a three-tiered system that includes the following components:

Basic Benefit Plan (Pension): Similar to the traditional pension plan, federal employees under FERS receive a defined benefit based on their years of service, high-3 salary, and a multiplier formula. This portion provides a guaranteed monthly annuity upon retirement for life.

Thrift Savings Plan (TSP): The TSP is a defined contribution plan that allows federal employees to contribute to a tax-advantaged retirement account. The government contributes an automatic 1% with up to another 4% matchin for a total of 5%. Employees can choose how to invest their TSP contributions among various investment funds.

Social Security: FERS employees also participate in the Social Security system, with deductions made from their salary. Social Security benefits are provided based on the individual’s earnings and work history.

FERS aims to provide federal employees with a comprehensive retirement package that includes a guaranteed pension, personal savings through TSP, and Social Security benefits. The combination of these three components is designed to provide a secure income stream for retirees. We will focus on covering the FERS basic benefit plan, also known as the FERS pension.

FERS is Not Created Equally for Everyone

If you entered service after 2014 you are paying 450% MORE into the same system. New FERS employees are paying 4.4% for the same exact pension that at one time only cost 0.8%. In total new FERS employees are having 12.05% deducted from their paychecks right off the top for legacy retirement systems.

FERS = Federal Employees’ Retirement System

FERS-RAE = Revised Annuity Employees

FERS-FRAE = Further Revised Annuity Employees

FERS

- Joined: 1/1/1987 – 12/31/2012

- 0.8% to FERS

FERS-RAE

- Joined: 1/1/2013 – 12/31/2012

- 3.1% to FERS

FERS-FRAE

- Joined: 1/1/2014 – Current

- 4% to FERS

Total Amount of Deductions for FERS Employees

Employees are required to pay into FERS, Social Security and Medicare. The employer also contributes 6.2% for Social Security and 1.45% for Medicare separately.

FERS

- 0.8% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 8.45%

FERS-RAE

- 3.1% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 10.75%

FERS-FRAE

- 4.4% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 12.05%

How to Retire

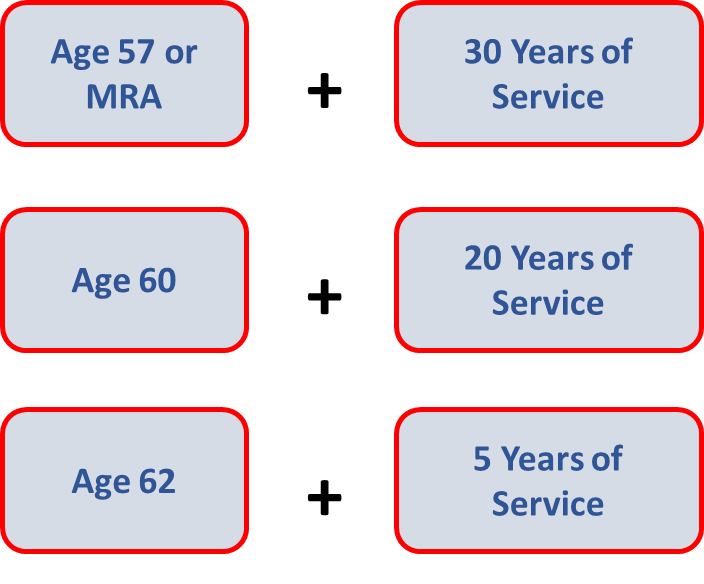

Eligibility to Retire on Immediate Unreduced Pension

An immediate retirement benefit is one that starts within 30 days from the date you stop working. If you meet one of the following sets of age and service requirements below, you are entitled to an immediate retirement benefit. If you retire at MRA with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

The early retirement benefit is available in certain involuntary separation cases and in cases of voluntary separations (Voluntary Early Retirement Authority – VERA) during a major reorganization or reduction in force (RIF).

Calculating Your FERS Pension Amount

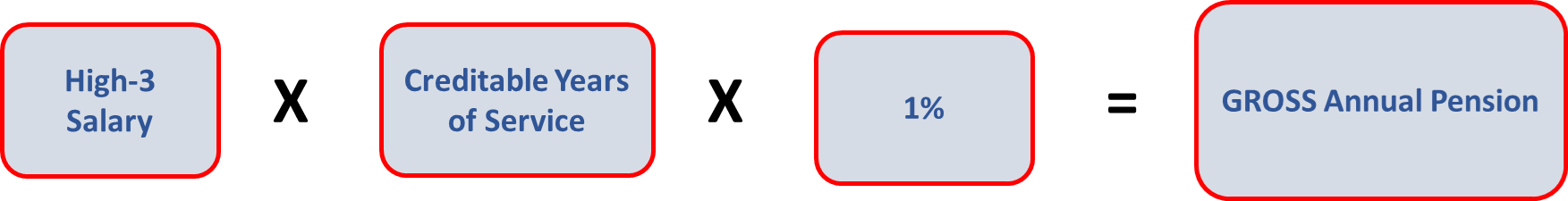

The high-3 salary is the average of the highest 36 months of consecutive income. For most people, the last 36 months are used for calculation purposes, but not always the case.

Basic Calculation

You will use the basic calculation if you fall under one of the following:

Retiring under age 62 with any number of years of service

OR

Retiring after age 62 with less than 20 years of service

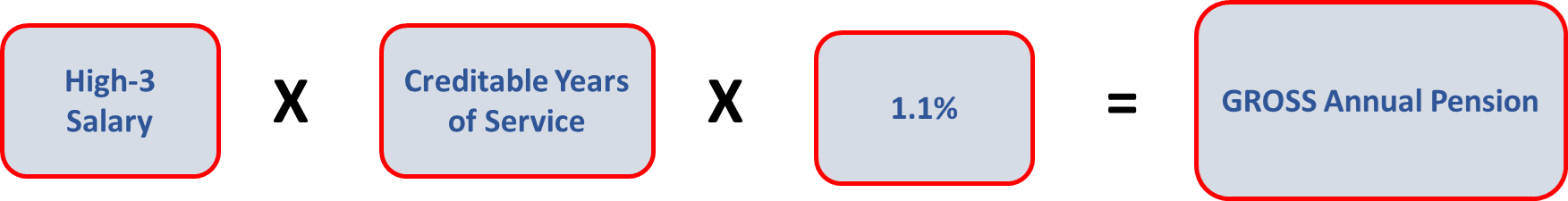

Bonus Calculation

You will use the basic calculation if:

Age 62 or After With at Least 20 Years of Service

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.