FERS Retirement Calculator

FERS Pension Calculation

Learn how to calculate your FERS retirement! The FERS annuity calculator will estimate how much you will receive at retirement. Instructions below the FERS calculator explain how to input the data fields to find the most accurate FERS pension calculation.

If you have any questions or are interested in a more detailed analysis of your federal retirement pension and benefits reach out to us! We provide a no-cost Federal Employee Benefits Report. Meet with one of our Fed-Expert Financial Planners to review each benefit based on your federal service and the optimal strategy when preparing for retirement. Schedule an appointment through our Contact Us page.

Knowledge is Confidence!

More Federal Retirement Calculators:

FERS Supplement Calcualtor

FERS Retirement Sick Leave Calculator

Thrift Savings Plan Calculator

How to use the FERS Estimate Calculator

To project your FERS pension, survivor benefit, potential penalities, and FERS annuity start date, enter the following information:

RSCD = Retirement Service Computation Date

The RSCD is used to calculate your federal years of service for the pension calculation. It is important to not confuse the RSCD with the LSCD date that is on your leave and earnings (LES) statement. Often, the LSCD and RSCD are the same, however it is better to assume they are not.

Retirement Type

Use the dropdown to select between regular retirement, MRA +10 (no penalty), MRA +10 (with penalty), or optional early out. If you are unsure of the definition of each retirement option. See below for a more detailed explanation.

Survivor Benefit Election

Choose between the three survivor benefit options available:

- 50% survivor benefit = cost is 10% of the pension

- 25% survivor benefit = cost is 5% of the pension

- No survivor benefit = no cost and max payout of pension

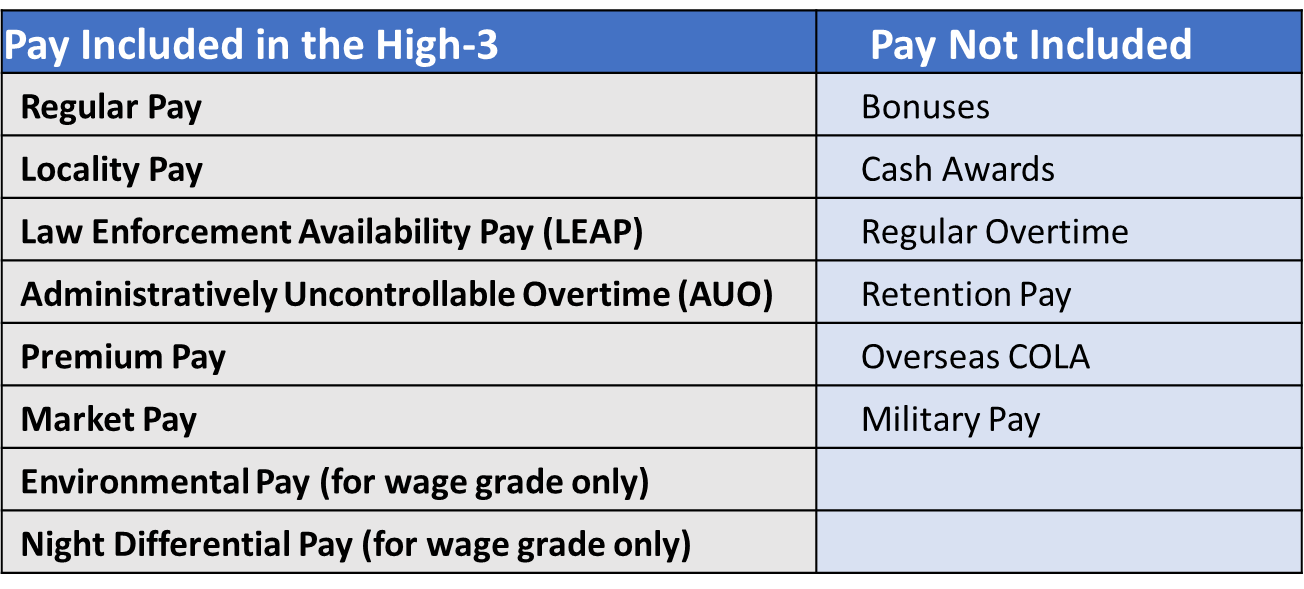

High-3

The high-3 salary is the average of the highest 36 months of consecutive income. For most people, the last 36 months are used for calculation purposes, but not always the case. Not all income is included in the high-3. See below for what is type of pay is included and not included in the high-3.

Number of Sick Leave Hours at Retirement

All unused sick leave is converted into months & days of service using the 2087 Chart. Use the Retirement Sick Leave Calculator to learn more.

- The converted time is added to your total service time

- Days over 30 will count towards as an additional month of service

- Left over days are discarded

Multiplier Received

The decision to retire before age 60 or after 62 can be a game changer for your retirement. If retiring before age 62 the multiplier used is 1.0%. If retiring after age 62 with 20 years of service or more the multiplier used is 1.1%.

Annual Early Retirement Penalty

Permanent penalty owed if you elect to start your pension immediately before eligible for an immediate unreduced annuity.

How is the penalty calculated?

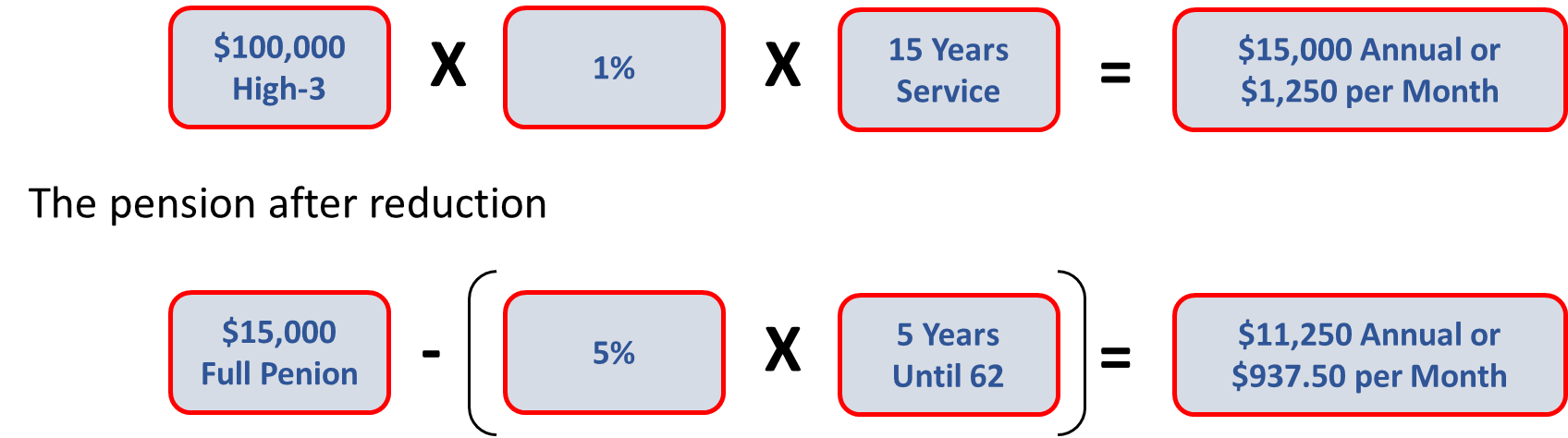

If you retire at MRA with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

You can retire after you turn MRA with at least 10 years of service, but you will pay a penalty.

- If you have less than 20 years of service, the pension will be reduced by 5% for each year you are younger than 62

- If you have more than 20 years of service, the pension will be reduced by 5% for each year you are younger than 60

Complete Guide to FERS – Federal Employee Retirement System

Below is a short summary of the following dropdown options to use the FERS calculator effectively. If you are looking to level up your federal benefit knowledge make sure to check out the Complete Guide to FERS. The guide is meant to be an exhaustive explanation of the FERS pension. The intention is to be a single resource when preparing for a federal retirement.

How to Retire from Federal Service

There are multiple ways to retire from federal service.

- Regular (immediate unreduced pension)

- MRA + 10

- Deferred

- Postponed

- Early Out (VERA)

- Disability

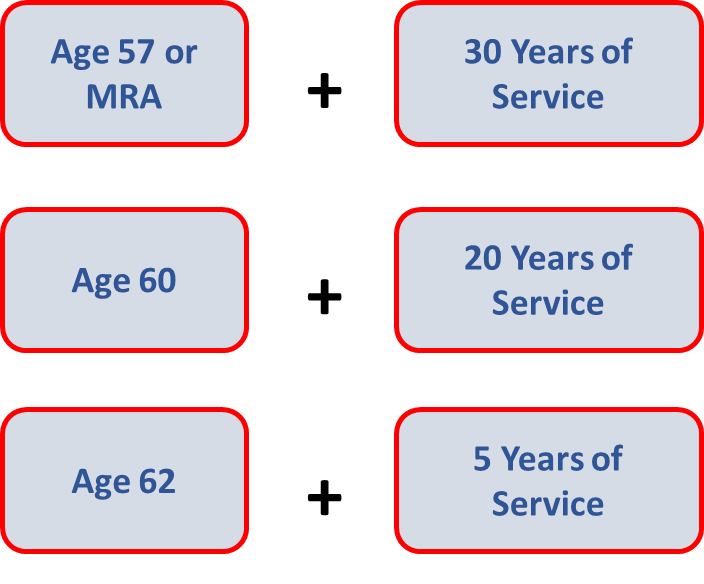

Regular Retirement – Eligibility to Retire on Immediate Unreduced Pension

An immediate retirement benefit is one that starts within 30 days from the date you stop working. If you meet one of the following sets of age and service requirements below, you are entitled to an immediate retirement benefit. If you retire at MRA with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

The early retirement benefit is available in certain involuntary separation cases and in cases of voluntary separations (Voluntary Early Retirement Authority – VERA) during a major reorganization or reduction in force (RIF).

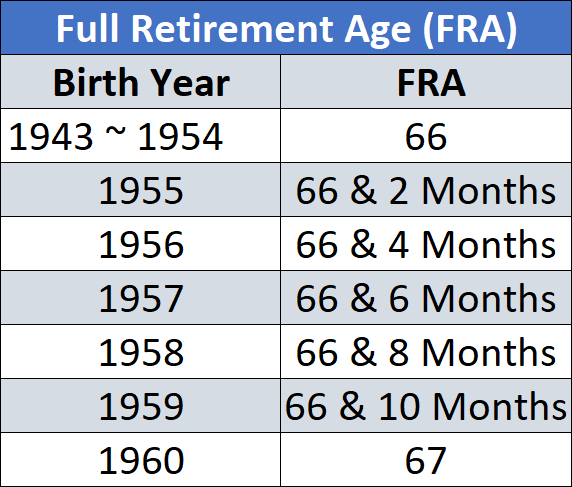

Minimum Retirement Age (MRA) is Dependent on Birth Year

Have a Conversation with a Federal Benefits Expert

Calculating your FERS pension is only the first step to establishing a successful federal retirement. Our team of Chartered Federal Employee Benefits Consultants (ChFEBC) will walk you through each federal benefit that you are entitled to and the best strategies to take advantage of. We will calculate FERS retirement, survivor benefits, FERS supplement calculation, FEGLI, FEHB, Medicare, Social Security, and Thrift Savings Plan strategies.

High-3 Calculation

The table below shows what is included and excluded from the high-3 calculation.

MRA + 10

If you retire at MRA with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

You can retire after you turn MRA with at least 10 years of service, but you will pay a penalty.

- Pension will be reduced by 5% for each year you receive an immediate pension before your eligibility age

- If you have less than 20 years of service, the pension will be reduced by 5% for each year you are younger than 62

- If you have more than 20 years of service, the pension will be reduced by 5% for each year you are younger than 60

- Eligible to keep FEHB & FEGLI in retirement

Example: Employee with 15 Years of service decided to retire at MRA (Age 57) with an average high 3 of $100,000. Full pension would be:

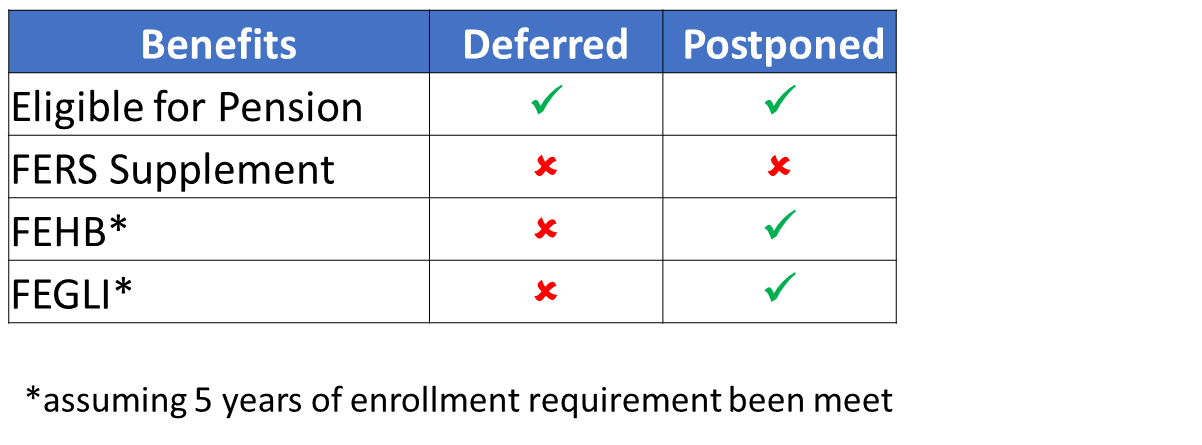

Deferred & Postponed Retirement

If you leave federal service before you meet the age and service requirements for an immediate retirement benefit, you may be eligible for deferred retirement benefits. To be eligible, you must have completed at least 5 years of creditable civilian service. You may receive benefits when you reach one of the following ages:

- 62 and 5 years

- 60 and 20 years

- MRA and 30 years

A deferred and postponed retirement will avoid the 5% penalty reduction to your annual pension. Essentially, you would be delaying your pension to a later date in lieu of an immediate pension. Be careful! Deferred vs. postponed are very different in the benefits you get to retain into retirement.

To simplify the difference, a deferred retirement is if you leave service BEFORE MRA and a postponed retirement is if you leave AFTER MRA.

Losing Certain Benefits in Retirement

A deferred retirement is not eligible for a Special Retirement Supplement (SRS), FEHB, and FEGLI. Losing FEHB in retirement is a huge loss. The Federal Government continues to pay ~72 – 75% of the FEHB premium even in retirement.

A postponed retirement allows you to keep FEHB & FEGLI once your pension begins. In the interim, there will be no FEHB or FEGLI coverage. In addition, there is no SRS.

“Early Out” – Voluntary Early Retirement Authority (VERA)

Often, a VERA can be confused with a Voluntary Separation Incentive Payment (VSIP) which is very different. A VERA allows you to retire on a full, immediate pension right away whereas a VSIP is only a one-time payment.

Voluntary Early Retirement Authority (VERA)

- No 5% per year penalty

- Eligible for FERS Supplement after MRA

- FEHB an FEGLI eligible

Voluntary Separation Incentive Payments (VSIP)

- One time payment of less than $25,000

- Repay if hired back within 5 years

- 100% Taxable

Disability Retirement

The Federal Government offers a very generous disability retirement. If disabled, employees will receive a portion of their salary until they reach age 62. At age 62, you will receive a full pension for life. The years you are disabled will count as eligible creditable years of service when calculating your pension computation.

FERS Disability Requirements

- Agency certifies that it’s unable to accommodate condition

- Requires applying for Social Security Disability (approval is not)

Amount of Disability Check

- First 12 months

- 60% of high 3 – (100% offset Social Security Disability)

- After 12 months

- 40% of high 3 – (60% offset Social Security Disability)

- After Age 62

- Normal FERS calculation but Disability counts toward service

Receive a Detailed Federal Benefits Report

Planning for retirement? Need to know your specific FERS pension numbers? Meet with one of our Chartered Federal Employee Benefits Consultants. At PlanWell, we take the time to offer a no cost and no obligation Federal Benefits Report unique to your numbers.

What the Federal Benefits Report covers:

- The Federal Employee Retirement System (FERS)

- Civil Service Retirement System (CSRS)

- Thrift Savings Plan (TSP)

- Survivor Benefits

- Federal Employees Group Life Insurance (FEGLI)

- Federal Employees Health Benefits (FEHB)

- Medicare

- Social Security

- Sick Leave Conversion

- Annual Leave Payout

- Federal Long-Term Care Insurance Program (FLTCIP)

- List of Action Items

Using the FERS Retirement Calculation for Federal Retirement Planning

Planning for a successful retirement is crucial for federal employees, and our FERS retirement calculator is designed to simplify this process. By using our federal retirement calculator a FERS employee can accurately estimate their future benefits. Our tool incorporates all aspects of FERS pension calculation, making it easy to understand how different factors impact your retirement income. Whether you’re calculating FERS retirement for the first time or refining your federal retirement strategy, our FERS retirement calculator provides a user-friendly interface for detailed planning. With our comprehensive FERS calculation for retirement, you can confidently plan for a financially secure future, ensuring that you maximize your benefits and achieve your retirement goals.

FERS Supplement Calculator

We tried our best to bring the most comprehensive FERS annuity calculator out there. The Special Retirement Supplement is a complex calculation that requires knowing individual federal service numbers and Social Security estimates. Reach out to us and we would be happy to provide an accurate estimate based on your federal retirement.

Planning for a successful retirement is essential for federal employees, and our FERS supplement calculator is here to help. This powerful tool assists you in understanding your FERS supplement calculation, giving you a clear picture of your future income. With our FERS annuity supplement calculation feature, you can easily determine your benefits and how they integrate with your overall retirement plan. By learning how to calculate your FERS supplement, you can make informed decisions that enhance your financial security. Our calculator also factors in the FERS Social Security supplement, ensuring you have a comprehensive understanding of your retirement income. By using our tool to calculate your FERS supplement, you can confidently plan for a prosperous retirement and make the most of your FERS retirement annuity supplement.

How Do You Calculate FERS Retirement?

If you are interested in learning more of how the FERS pension is calculated. Check out our How to Calculate Your FERS Pension – The Short Version!.

Interested in becoming a FERS retirement expert? We’ve created an exhaustive explanation of the FERS pension which was created to be a single resource when preparing for a federal retirement. Complete Guide to FERS – Federal Employee Retirement System

Planning for federal retirement can be a complex process, but using a FERS retirement calculator can simplify it significantly. Understanding how FERS retirement is calculated is the first step towards a secure financial future. This article will explain how to use various FERS calculators and how they can help you prepare for your retirement.

Understanding FERS Retirement Calculation

The foundation of your retirement planning begins with knowing how FERS retirement is calculated. The basic formula considers your years of service, your high-3 average salary, and a multiplier based on your retirement age and years of service. Tools like the OPM FERS calculator and the federal FERS retirement calculator provide a straightforward way to input these variables and see your estimated retirement benefits.

Using the FERS Calculator

The OPM FERS retirement calculator is very basic compared to our FERS retirement calculator. It is an essential tool for federal employees. It allows you to input your specific data and see a detailed breakdown of your potential retirement benefits. This calculator is particularly useful for those nearing retirement, as it can provide a comprehensive view of what to expect.

Addressing Specific Scenarios

Divorce and Retirement: The FERS divorce calculator helps you understand how a divorce could affect your retirement benefits, ensuring that you can plan accordingly.

Deferred Retirement: If you’re considering deferring your retirement, the FERS deferred retirement calculator can show you the impact of this decision on your benefits.

Lump Sum Payments: The FERS lump sum calculator helps you decide whether taking a lump sum payment is the best option for you.

Offset Scenarios: For those with additional factors like disability or Social Security offsets, the FERS offset calculator provides valuable insights.

Calculating Retirement Dates and Taxes

Determining the best time to retire is crucial. The FERS retirement date calculator helps you identify the optimal retirement date to maximize your benefits. Additionally, the FERS retirement tax calculator provides an estimate of the taxes you’ll owe on your retirement income, ensuring there are no surprises.

Specialized Calculators for Detailed Planning

Military Service: If you have military service, the FERS military buy back calculator can help you understand how buying back your military time can increase your retirement benefits.

Sick Leave: The FERS retirement sick leave calculator and the FERS sick leave conversion calculator allow you to see how your unused sick leave can enhance your retirement package.

Early Retirement and MRA: The FERS early retirement calculator and the FERS MRA calculator are useful for those considering retirement before reaching the minimum retirement age (MRA).

Comprehensive Tools

For a more holistic view, the FERS annuity calculator OPM and the FERS basic benefit plan calculator offer detailed insights into your annuity and overall retirement plan. Examples like the FERS calculation example and how to calculate FERS retirement examples provide practical guides to understanding your benefits.

Additional Considerations

Federal employees in specialized roles, such as law enforcement officers, can use the FERS LEO retirement calculator to understand specific retirement benefits. For those in the Further Revised Annuity Employee (FRAE) category, the FERS FRAE calculator is essential.

Using the right tools, such as the FERS calculator online, the USPS FERS retirement calculator, and the TSP FERS retirement calculator, can transform your retirement planning experience. By leveraging these calculators, you can make informed decisions, optimize your retirement benefits, and ensure a financially secure future. Remember, thorough planning today leads to a comfortable and worry-free retirement tomorrow.

FERS Pension Calculation Workshops - FERS Webinars

Federal employees seeking a successful retirement can greatly benefit from our FERS retirement calculator. Designed with ease of use in mind, our FERS retirement calculator in Excel allows you to input various scenarios and instantly see your potential benefits. Whether you’re new to using a FERS calculator for retirement or looking to refine your retirement plan, our tool helps you calculate FERS benefits accurately and efficiently. By utilizing our FERS benefit calculator, you can gain a comprehensive understanding of your retirement income, ensuring that you make informed decisions for a secure financial future.

FERS Financial Advisor for Federal Employees Near Me

Understanding how to calculate federal retirement FERS benefits is crucial for federal employees planning for a secure future. Our OPM FERS retirement calculator is designed to simplify this process, offering a detailed and user-friendly interface. With our tool, you can see a FERS retirement calculator example to guide you through each step of calculating your FERS pension. Whether you’re using our federal pension calculator for FERS or exploring the FERS disability retirement calculator, you’ll find all the resources needed for accurate FERS calculations. Our calculator ensures you can confidently plan your retirement, making well-informed decisions for a comfortable and financially stable future.

FERS Financial Planner for Federal Employees Near Me

For federal employees planning their retirement, understanding how to calculate a FERS annuity is essential. Our retirement calculator FERS tool simplifies this process, providing a clear and user-friendly experience. Learn how to calculate your FERS pension with our comprehensive federal FERS pension calculator, designed to guide you through each step of calculating your FERS pension. With our FERS calculator app and OPM retirement calculator FERS resources, you can access powerful tools on the go. Our FERS retirement calculator online offers instant calculations, ensuring you have accurate and up-to-date information. Whether you’re looking to calculate your FERS annuity or explore different FERS retirement calculators, our platform provides all the resources you need for effective retirement planning.

Contact Us

When you are left wondering how to plan for retirement, PlanWell Financial Planning can guide you every step of the way. From establishing goals to implementing strategy and mitigating risk, we will make sure that your retirement plans are taken care of. To reach us, you can fill out our online form here, call, or email for any of your retirement planning needs. We’d love to help.