Have you retired or recently left Federal service? If so, you are probably wondering what you should do about the TSP. Should you leave your retirement funds with the Thrift Savings Plan (TSP) or transfer into a Individual Retirement Account (IRA)? It is an important question to ask.

What does TSP do well?

Some of the advantages of TSP are also disadvantages so continue reading until the end to find out why.

- Simple and easy to use

- The investment options are simple and straightforward. There are 5 “core” funds along with the lifecycle funds to choose from (excluding the mutual fund window). If you stay with TSP, you also do not need to spend time researching other financial institutions and individual investments.

- Low cost

- The average expense ratio for the “core” and lifecycle funds is around 0.07%. That’s about as low as it gets.

- G fund

- The G fund is unique only to TSP and is guaranteed by the US Government. As far as our understanding, you are unable to find a similar investment out there. The G fund’s investment objective is stated as follows: “to ensure preservation of capital and generate returns above those of short-term U.S. Treasury securities.”

- Mutual fund window

- The introduction of the mutual fund window now provides Federal employees the ability to choose from over 4,000 mutual funds.

- Required Minimum Distributions (RMDs) are automatic

- TSP will automatically calculate and disburse your RMDs each year they are due. The auto payment is a great benefit to help prevent the high penalties that are accompanied if you miss an RMD.

What does TSP not do well?

- Not the lowest cost

- Yes, an average 0.07% is very low and competitive, however there are lower costs out there. You can find similar funds to the “core” funds at a lower cost and at some financial institutions at 0.00%.

- No Roth conversions

- TSP participants are unable to conduct Roth conversions inside the TSP. Roth conversions can become an impactful tool at retirement. It allows you to reduce future RMDs which can ultimately help to lower future taxes and Medicare Part B premiums in the future.

- Limited investment options

- The TSP is limited in the funds available for investment. The bulk of the funds, 75%, must be invested in the 5 “core” funds.

- Mutual fund window

- Does not offer ETFs or individual stocks

- $55 annual administrative fee and $95 annual maintenance fee

- $28.75/trade fee

- Additional operating expenses dependent on the mutual fund chosen

- Withdrawal options lacking

- Only 12 withdrawals per year with a 30-day waiting period after each withdrawal. Why is your money limited to every 30 days?

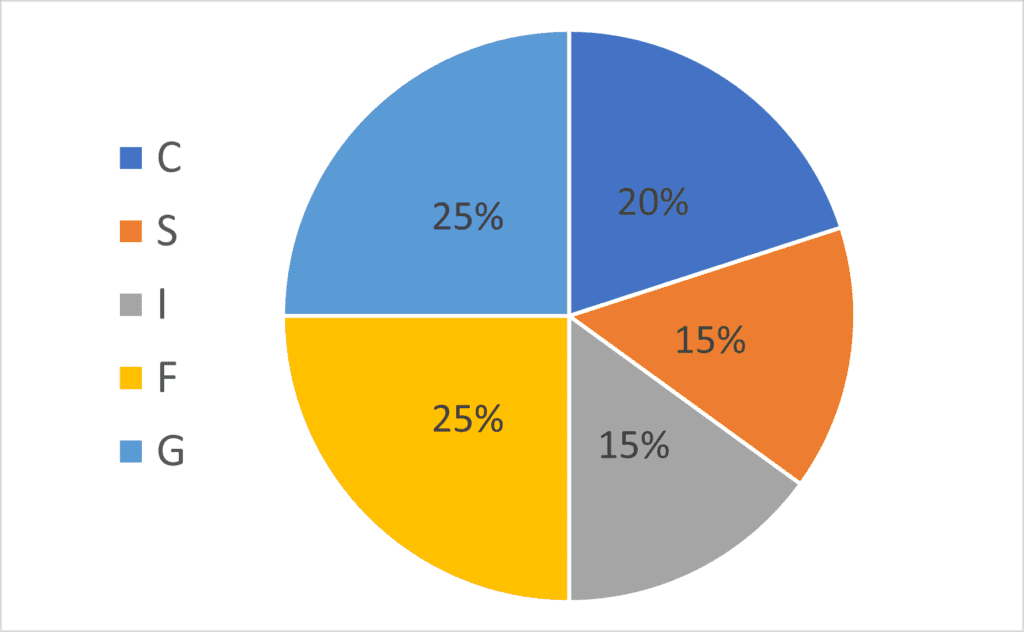

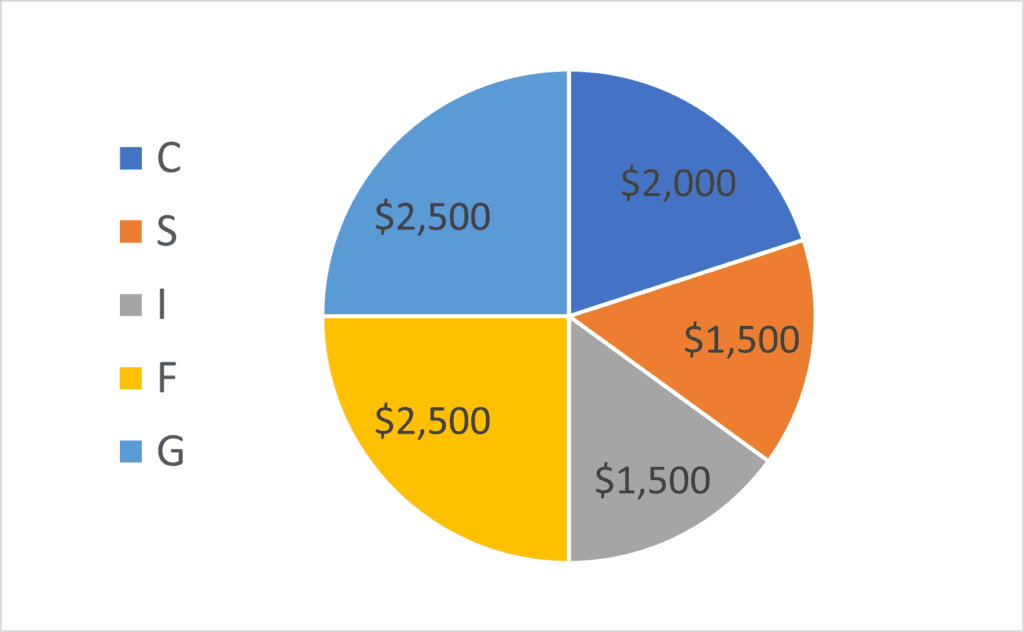

- Pro rata rule applied to withdrawals. If you take a withdrawal, the money must come out pro rata based on your investment allocation. This becomes an issue if you need to make a withdrawal or are receiving monthly income. If the stock market has a major decline, you do not want to take a withdrawal from the investments that are getting beaten up the most. It is more beneficial to strategically choose the investments that are performing the best and take the withdrawal from there. Below shows an exmple of a $10,000 withdrawal.

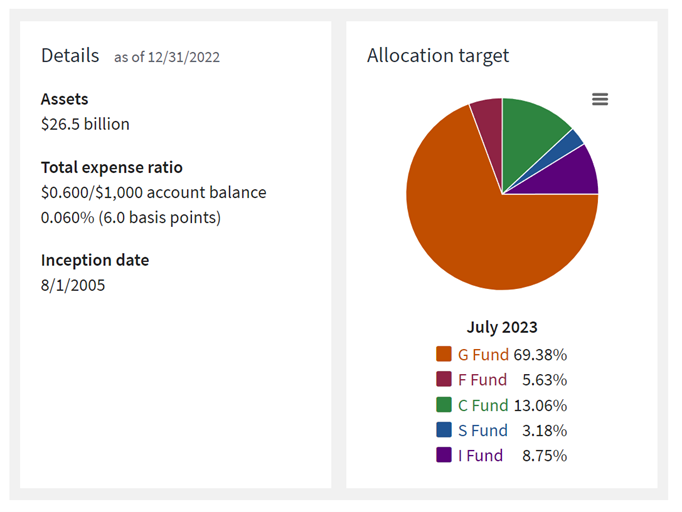

- Lifecycle funds

- The lifecycle funds are often chosen as a “set it and forget” strategy. This type of thinking can become problematic as retirement nears. As you can see below, we have included the allocation for the L Income fund, which each lifecycle fund eventually ends based on the target date chosen. The L Income fund becomes very G fund heavy and may leave your retirement nest egg falling short of inflation in the long-term.

- No guidance and limited customer support

- You are on your own. TSP is unable to give guidance on your account in regards to distributions, taxes, and investment strategy.

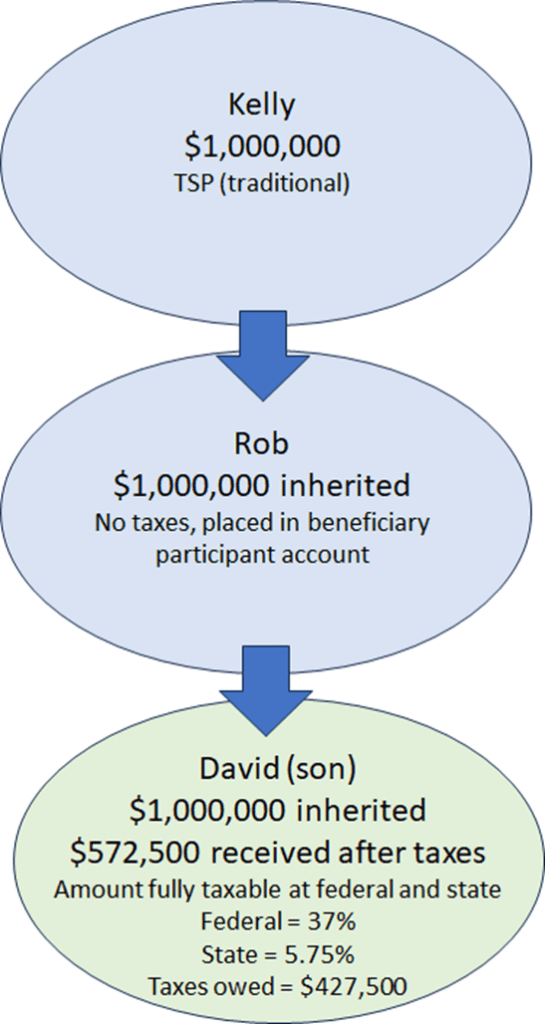

- Beneficiary designations and inheritance process

- There are no issues if a spouse receives the TSP if you predecease him/her, but what happens when a beneficiary participant dies? The money cannot remain in the Thrift Savings Plan. The payments must be made DIRECTLY to whom the beneficiary participant has chosen. That means, the money cannot be rolled over into a beneficiary IRA. This could result in a major tax liability for the beneficiary of a beneficiary participant.

- For example, say you predecease your spouse. Your spouse receives the TSP funds into a beneficiary participant account. When your spouse passes away, the funds go to your son or daughter. In this scenario, the full amount received will be TAXABLE. This is a huge problem. The children will be unable to place these funds into an inherited IRA and could possibly be taxed at the highest tax bracket.

Summary

When you retire or leave Federal service, it is important to consider all the options available. It can be comfortable to keep the status quo, but we would urge taking the time to do the research. You have saved an entire career to get where you are now. Don’t make an uninformed decision on a big part of your financial plan.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.