TSP does a lot of great things for federal employees while they are working, however the mechanics of TSP for retirees can cause issues. Check out more info on Should You Transfer Out of Thrift Savings Plan (TSP)?

One of the major problems that can arise is related to estate planning with the Thrift Savings Plan. Federal employee’s family members can be left with a huge tax burden if proper planning is not in place. Did you know that a beneficiary of TSP can be forced to receive the TSP funds as a 100% withdrawal? There would be no option of rolling over into a beneficiary account. For most people, this would mean being taxed at some of the highest federal and state tax brackets.

Beneficiary Designations

There is an important distinction to make when understanding TSP beneficiaries. You have a participant beneficiary and then the beneficiary of a particpant beneficiary.

Inheritance Process

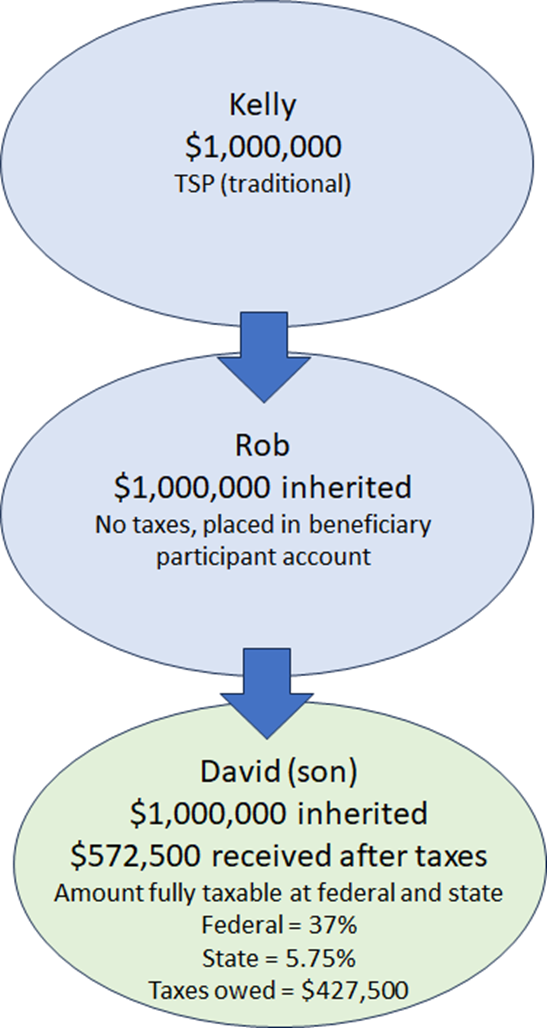

There are no issues if a spouse (or primary beneficiary) receives the TSP in the event you predecease him/her. What happens when a beneficiary participant dies? The money cannot remain in the Thrift Savings Plan. The payments must be made directly to whom the beneficiary participant has chosen. The beneficiary of a beneficiary participant will be taxed at 100% of the account value at federal and state taxes. Consequently, the TSP funds cannot be rolled over into another beneficiary participant account to continue the deferral of taxes.

For example, say you predecease your spouse. Your spouse receives the TSP funds into a beneficiary participant account. When your spouse passes away, the funds go to your son or daughter. In this scenario, the full amount received will be TAXABLE. The children will be unable to place these funds into a beneficiary participant account and could possibly be taxed at the highest tax bracket.

Reach Out to Us!

If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.