FLTCIP & Long-Term Care

Related Posts

Federal Long-Term Care Insurance Program (FLTCIP)

The Federal Long Term Care Insurance Program (FLTCIP) is sponsored and regulated by the Office of Personnel Management (OPM) and administered by John Hancock. The program was established in 2002 as a result of an act of Congress, the Long-Term Care Security Act of 2000. FLTCIP is on a renewable 7-year contract that must be approved by Congress.

Who is Eligible to Apply?

Federal and U.S. Postal Service employees and annuitants, active and retired members of the uniformed services, and their qualified relatives are eligible to apply for coverage.

Long-Term Care Uses

- Home Care assists with ADLs inside the home

- Assisted Living provides a community that is focused on a social lifestyle for seniors who are generally active but need some help with everyday tasks

- Nursing Homes provide long-term medical care for adults with serious health issues. Nursing homes usually cost more than assisted living due to the higher level of care.

Key Features

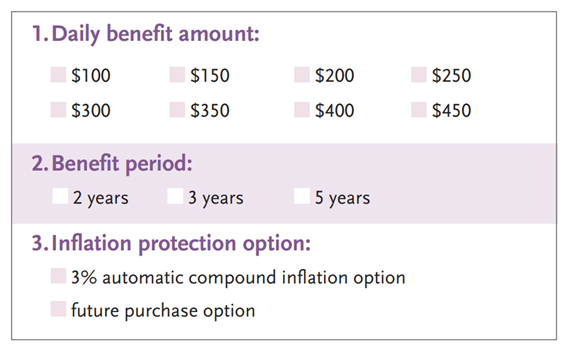

Daily Benefit Amount (DBA)

This is the maximum amount your insurance will pay a day. FLTCIP offers eight daily benefit amounts (DBAs) from $100 to $450 in $50 increments.

Benefit Period

This is the length of time benefits will be paid if you receive benefits every day equal to your full daily benefit amount (DBA). You can choose from a 2, 3, or 5 year benefit period. If you receive services that cost less than your DBA or you don’t receive services every day, your benefits will last longer than your benefit period. The benefit period is used together with the DBA to calculate the maximum lifetime benefit.

Inflation Protection Options

Added feature that ensures your benefits keep pace with inflation. There are two types of inflation protection options offered by FLTCIP.

Option 1 = 3% Automatic Compound Inflation Option (ACIO)

The DBA automatically increases by 3% compounded every year. The premium does not increase each year, however premiums are not guaranteed to not increase in the future. The premiums are generally higher with this option.

Option 2 = Future Purchase Option

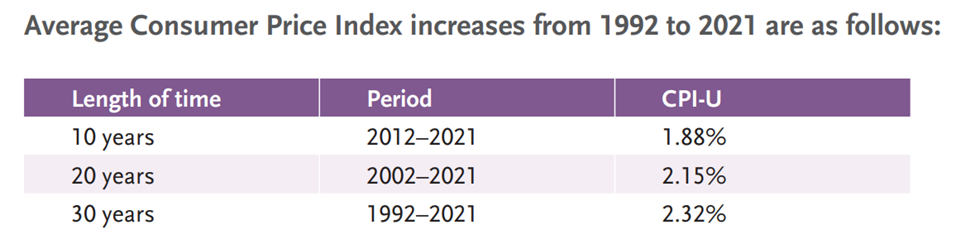

You are given the opportunity to increase your DBA every two years with a corresponding increase in your premium. You may decline the increase a maximum of three times before you stop receiving offers. The increase in your benefits is based on the Consumer Price Index for All Urban Consumers (CPI-U).

The amount of the increase to your DBA and the corresponding increase in your premium will be sent in a notice every two years prior to the increase effective date. The increase will automatically take effect unless declined.

If you select the future purchase option, your premium will increase for each inflation increase under this option unless you decline offers. The additional premium for each increase will be based on your age and the premium rates in effect at the time the increase takes effect. As your benefits increase, your future purchase option (FPO) premium also increases and may eventually become greater than the ACIO premium.

What is the Maximum Lifetime Benefit?

The maximum lifetime benefit (MLB) is the maximum amount your coverage can pay.

MLB calculation = daily benefit amount x benefit period (in days)

Example:

Daily Benefit Amount = $200/day

Benefit Period = 3 years or 1,095 days

Maximum Lifetime Benefit amount is $219,000.

Customize Plans

Below are the options available to customize a plan for FLTCIP 3.0.

How are Premiums Determined?

Premiums are based on your age and the premium rates in effect at the time the application is received. Premiums are guaranteed renewable, meaning that John Hancock cannot cancel your coverage if you pay your premium on time. Premiums are unaffected based on increasing age or health status. However, this does not mean that premiums are guaranteed to remain unchanged. We have seen a history of the premiums increasing in cost every 7 years. Historically, premiums have increased severely each time the 7-year contract was up for renewal. In 2016, premium rates rose 83% on average, and as high as 126%. In 2009, premiums rates increased on average 17%, and as high as 25%. In 2023, we saw increases from 49% up to 86%. The good news is that OPM must approve any premium changes and the rates will not increase during the 7-year contract period.

Premium Increases

John Hancock has the right to increase premiums in the future. The premium may NOT increase based on your individual age or health. It may only increase if you are among a group of enrollees whose premium is determined to be inadequate. While the group policy is in effect, OPM must approve the increase in premium.

Waiting Period

The waiting period is 90 days. Benefits are not paid during this time, except for hospice care, respite services, and the stay-at-home benefit. The waiting period is only once in your lifetime. Days applied toward satisfying the waiting period need not be consecutive, nor associated with the same episode of care.

Waiver of Premium

The premium is not owed if you are eligible for benefits and have satisfied the waiting period.

Eligibility of Benefits

Eligibility for LTC requires you are unable to perform at least two activities of daily living (ADLs).

- Bathing

- Dressing

- Toileting

- Continence

- Eating

- Transferring (from bed to chair)

Summary

FLTCIP is a great program, but keep in mind it is not the only program available. In the past several years, multiple competitors have joined the market with solutions that may better fit your needs. A key advantage of FLTCIP is that the premium will not increase in between the 7-year contract period whereas other LTC providers may increase the premiums on an annual basis. Make sure to do your homework and review all the options available. LTC is a long-term commitment and a large expense. The decision should not be chosen loosely.

Federal Retirement Planning

At PlanWell, we are focused on federal retirement planning. If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). Choose a Financial Planner for federal employees. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds! Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.

Federal Retirement Workshops - FERS Webinars

Sign up today for our FERS webinar here. Federal retirement webinars designed to cover every benefit in only 3 hours. The FERS workshop covers: FERS pension, survivor benefit, Social Security, Special Retirement Supplement (SRS), Thrift Savings Plan (TSP), Federal Employee Group Life Insurance (FEGLI), Federal Employee Health Benefits (FEHB), and Federal Long-Term Care Insurance Program (FLTCIP). Interested in having PlanWell host a federal retirement seminar for your agency? Reach out, and we can coordinate with your agency’s HR to have an on-site federal retirement seminar. PlanWell can do a FERS seminar or CSRS seminar.

Financial Planner for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning to sit with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized FERS estimate.