Will I Get Social Security If the Trust Fund Goes Bankrupt?

The latest trustee report projections from Social Security indicated that the trust fund will be depleted by 2035. After depleting the fund, it can still pay about 83% of the scheduled benefits. What does that mean? How can it still pay 83% of the benefits if the trust fund has gone bankrupt? Let’s explore how the Social Security Administration can deliver even when it runs out of money.

What Happens if the Social Security Trust Fund is Delpleted?

This has been the headlines. Most people think that if the trust fund runs out, millions of retirees will stop receiving their Social Security Payments. This is not true. Although the updated Social Security Trustees projections estimate that the trust fund’s reserves could be depleted as early as 2035, most Social Security payments are backed by current payroll taxes. That’s why even if the trust fund is depleted, it can still pay 83% of the full benefit.

Should I Include Social Security Benefits In My Retirement Plan?

As a financial planner, I get these questions all the time. The most conservative clients do not want to include the Social Security program when they plan for retirement. However, after we reviewed what the trust fund is and how the benefits are funded by current tax revenue. The next question I get is how much we can count on and if benefit cuts may be expected over the years. Before I answer their question, I would propose a question instead:

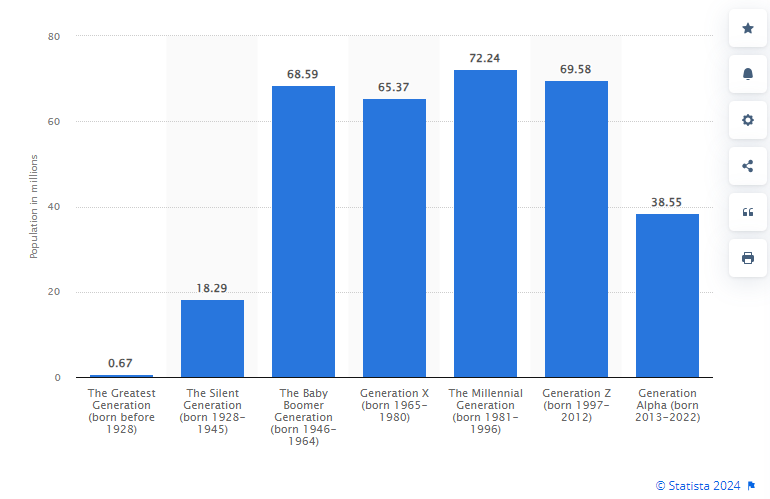

Who do you think is the biggest population count by generation? Baby Boomers, Generation X, Millennials, or others?

Most often, the response is “The Baby Boomers”. Is that your response as well? If so, you are wrong! The biggest population by generation count is the Millennials, who are between the ages of 43 and 28. This generation was hit hard by the financial crisis and Covid, so their earning potential suffered. However, as more boomers retire, they are getting better jobs with higher incomes and pay more Social Security Taxes.

What about the second biggest population count by generation?

This has to be the Baby Boomers, right? Wrong again. The second biggest population count by generation is Generation Z, between the ages of 27 and 12. They are just starting their adult lives. As more GenZers enter the workforce, they will only increase Social Security payroll taxes and ensure that benefits are paid even after the trust fund’s depletion.

2022 US Population by generation

Population growth certainly does not guarantee that Social Security will not run out of money in the future. However, it does indicate that including it in retirement income planning is reasonable. So, if you want to plan on the more cautious side, I would suggest you consider receiving 70% of the benefit payments.

Will Social Security Solvency Be Resolved?

This cannot be done without Congress acting. In fact, they already increased the taxable wage base, so higher income earners are paying more Social Security Tax. Second, the recent interest rate increases also mean the trust fund has earned better returns. These two are the biggest reasons the deletion date has been pushed back to 2035. Also, with the prospect of additional workers, the current pay benefits to beneficiaries have increased from 75% in 2010 to 83% in 2024.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.