How much should you contribute to TSP?

What’s the ideal amount for you to save, and what constitutes the most effective utilization of TSP? We will address savings rates and debunk common TSP misconceptions, ensuring you feel confident that your TSP is being optimized for your specific situation.

What is the TSP match?

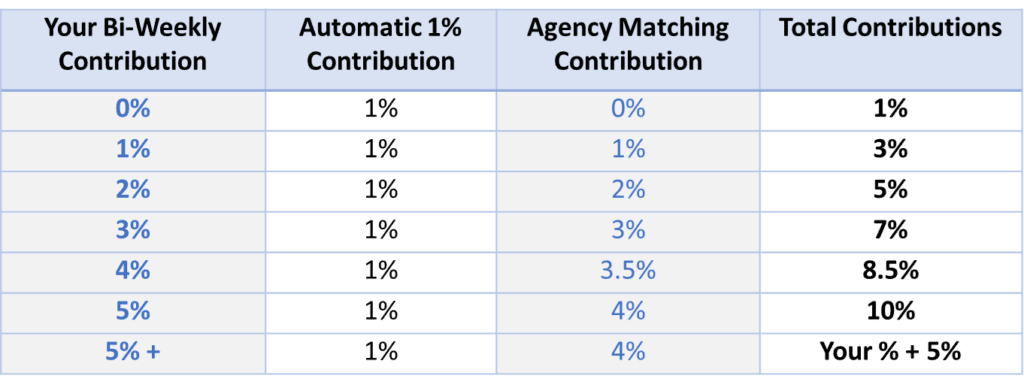

Federal employees receive an automatic 1% government contribution regardless of your contribution amount. You can contribute nothing and still receive a 1% contribution. In addition, federal employees receive a 4% government match based on the employee’s contribution amount. If a federal employee contributes at least 5% you will receive an additional 4% government matching contribution for a total of 5%.

Common misconception!

Contributing the max into the Roth TSP will result in losing the 5% government match. At least 5% must be going to traditional TSP to receive the match.

You may contribute the max into Roth TSP and still receive the 5% TSP match. The government will not place your match into Roth. 100% of the government match goes into traditional TSP.

How Much Should You Contribute into TSP?

The obvious answer is the maximum amount, but what about people who do not have the means to meet the maximum or have other obligations such as debt that needs to be paid off? Maybe you are trying to save for your children’s college education. There is no perfect answer since everyone’s financial situation is different.

The one answer that applies to everyone – contribute a minimum of 5%. Essentially, your return on investment is 100% when you receive a match. Contributing less than 5% is leaving free money on the table.

What if you have debt that needs to be paid down?

Contribute at least 5%, then work on creating a plan to pay down the debt.

Start by paying down the debt with the highest interest rate first. Consider speaking with the bank about lowering the interest rate or creating a payment plan.

What if you have no debt?

Contribute at least 5%, then look at building up an emergency fund to meet 3-6 months of your expenses.

Place the funds into a high-yield savings account or money market savings that does not limit your withdrawals to more than six per month. You will need the funds to be liquid for an emergency without penalty.

What if you have no debt and have an emergency fund?

Contribute at least 5%, then work on increasing your contributions into TSP until you reach the maximum allowable limit.

If you’ve already maxed out your TSP contributions, congratulations! You’re outperforming the majority of Americans and paving the way for a successful retirement. The next option is to create a taxable investment account, allowing you to make systematic contributions on a bi-weekly or monthly basis. Implementing a dollar-cost-averaging approach to channel funds into a predefined investment strategy can potentially yield higher growth over the long term compared to leaving the money idle in a bank account.

Do Not Max Out to Soon

If you are maxing out TSP contributions, make sure you are not meeting the maximum contribution limit too early in the year or it can result in missing the TSP match. Make sure to take the maximum amount of $23,000 or $30,500 and divide it over the amount of pay periods you receive for the year. For example, if you were to max out by June 1st you would miss out on half the years 2% match which can result in the loss of thousands of dollars in matching.

If you are on 26 pay periods:

- $884 per pay period for $23,000

- $1,173 per pay period for $30,500

Difference Between Traditional TSP and Roth TSP?

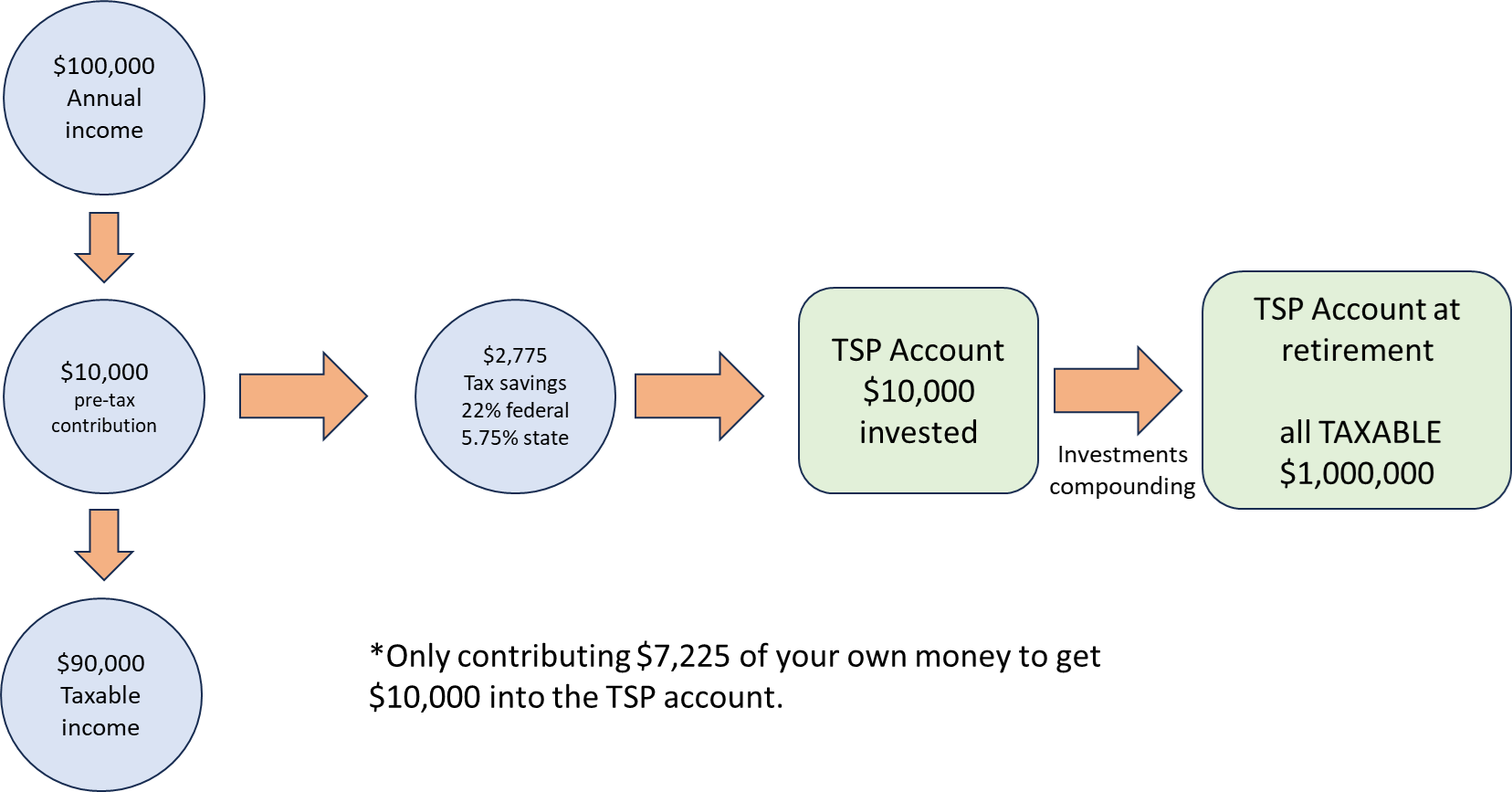

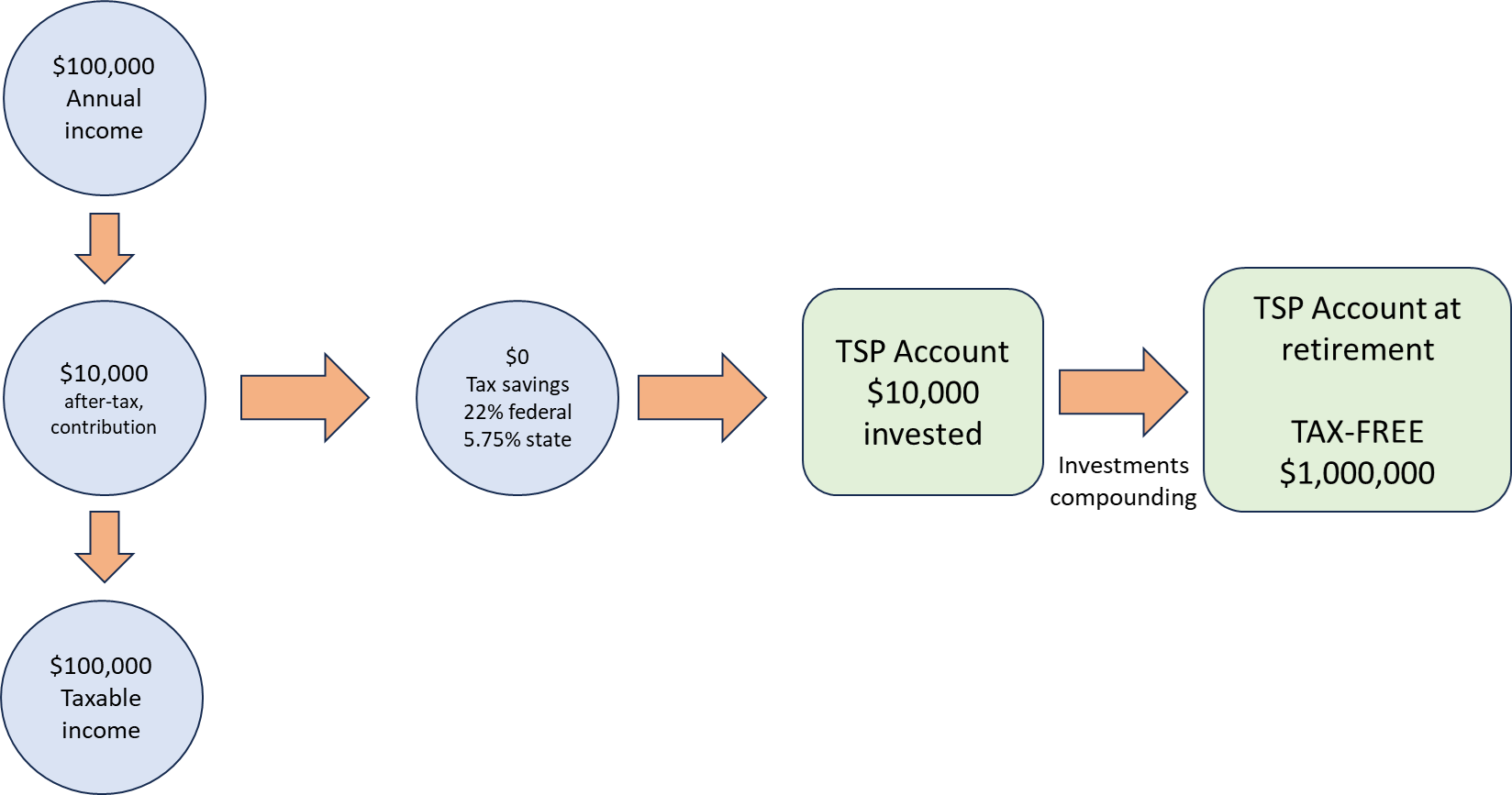

Traditional TSP contributions receive a tax deduction immediately on federal and state taxes. Traditional is also known as a pre-tax contribution. Both the cost-basis and investment growth are 100% taxable at retirement. Most federal employees will not be in a lower tax bracket at retirement and should consider doing Roth TSP.

Roth TSP contributions are contributed with after-tax money and do not receive a tax deduction for federal and state taxes, however all of the investment growth is tax-free at retirement.

Common misconception!

My income is too high to contribute into a Roth TSP.

We often hear that federal employees have not been contributing to Roth TSP because they thought their income was too high. There are no income limits for Roth TSP. You can earn well above the income limits that are required for Roth IRAs and there will be no issue.

Annual Contribution Limits

There is a maximum amount you can contribute into TSP per year.

- $23,000 (2024)

- $7,500 if over age 50 (2024)

Reach Out to Us!

If you have additional federal benefit questions, reach out to our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.