TSP Talk: C Fund Return: Thrift Savings Plan Investment Outlook for Federal Employees. Review the C fund’s past performance history and future price outlook based on its underlying S&P 500 stock index. Make informed investment and retirement decisions.

Understanding the TSP C Fund: Investment Returns and Next 10 Years: Future Performance

The Thrift Savings Plan (TSP) is a component of retirement planning for federal employees, offering a range of investment options to help build a secure financial future. Among these options, the TSP C Fund stands out as a popular choice for those looking to capitalize on the growth potential of the US stock market.

Estimate your retirement income with our TSP Calculator.

What is the TSP C Fund and How Does it Work?

The TSP offers several funds, each with different investment objectives and risk levels, allowing participants to tailor their portfolios to their individual retirement goals. The TSP C Fund is one of these options, focusing on equity investments to achieve growth over time.

Understanding the C Fund’s Stock Index Investment

The TSP C Fund is a stock index fund that aims to match the performance of the S&P 500 Index, which comprises 500 large U.S. companies. By investing in the stocks of these 500 companies, the C Fund seeks to provide broad market exposure and capitalize on the long-term growth potential of the U.S. stock market. This index investment strategy allows the C Fund to benefit from the collective performance of the largest and most established companies in the country, making it a core component of many investors’ portfolios.

Role of the 500 Index in C Fund Returns

The performance of the TSP C Fund is closely tied to the S&P 500 Index, as it seeks to replicate the index’s returns. The 500 Index serves as a benchmark for the C Fund, and its performance is influenced by the collective earnings and stock prices of the 500 companies it comprises. As these companies grow and generate profits, the index—and consequently, the C Fund—benefits from increased stock prices and dividends. Therefore, the health of the U.S. economy and the performance of these companies are critical factors in determining the C Fund’s returns.

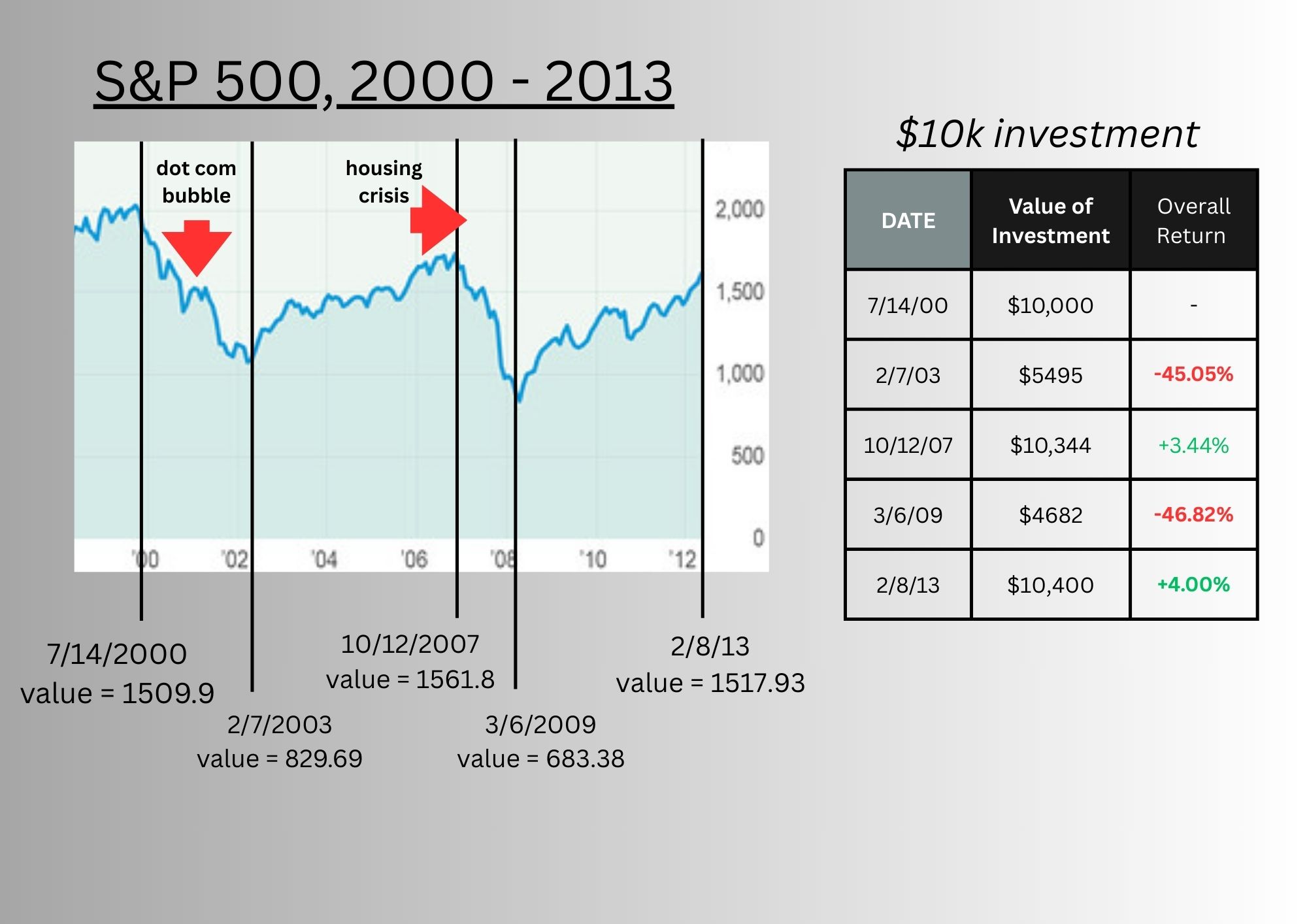

Stock Index Fund, C-Fund Facing Another “Lost Decade” ?

With recent volatility in the US stock market, mostly caused by uncertainty revolving around the recent tariffs and other Trump policies, many investors have been worried that the S&P 500 could be headed for a stretch of losses similar to 2000 to 2010. This timeframe has been coined as “the lost decade” due to the fact that if you invested money at the peak of the dot-com bubble in 2000, your investment would not have recovered to its original value until 2013! Will something like this happen again? It’s difficult to predict the future, but there are ways to manage your investments so your retirement is not negatively impacted by downturns in the underlying index of the Thrift Savings Plan’s C Fund.

Ready to Retire? Get the Free FERS Guidebook PDF.

S&P 500 Chart, 2000 – 2013

Investment Strategy for Federal Employees: Diversification is Key

Many types of diversification are optimal when developing a financial plan. Other than tax diversification (retirement assets, both traditional and Roth, and non-retirement accounts), there are many ways to diversify investment allocations. There are domestic and international securities, and with securities, there are bonds and stocks. Within stocks, there’s size diversification (small, medium, and large companies), equities considered “growth” and “value,” and then there different sectors of the market to consider as well, with a few examples being tech and energy. A financial advisor can help investors ensure they are properly diversified as to align with their risk tolerance and time horizon. Value stocks and international investments preformed much better than the C fund during the lost decade, accentuating the importance of spreading one’s investments across different opportunities.

Investments Issues with TSP Funds, Including the G Fund

As examined in our recent article about investment limitations of the thrift savings plan (TSP), there’s not much flexibility within the TSP when it comes to diversifying. For most participants in the federal employee retirement plan, there are five choices to invest in: the C Fund (S&P 500), F Fund (Aggregate Bond Fund), S Fund (US stocks, small, medium, and large), the I fund (international stock fund – does not include China), and the G Fund (return is based off average return of US Treasury securities). Beyond that, the only way to strategically target specific areas of the markets is within the TSP mutual fund window – and that can be restrictive and expensive to make use of. The solution? Meet with fed-expert financial planner that can help you allocate investments both within and outside of the TSP, ensuring you are properly diversified to meet your retirement goals. Avoid a potential second lost decade, schedule a meeting and start planning your future.

Calculation for Loss Recovery from Investment Portfolio

Losing less than the overall market is losing can be an important concept to grasp when evaluating your portfolio performance. To summarize, if you lose a given amount (X), it takes more growth and time to recover than if you lost any amount less than X. Using the chart above as an example, someone who invested $10,000 in the S&P 500 (without taking trading expenses or dividends into account), would’ve been down $5318 dollars on March 6, 2009. To get back to the original value, it would need a return of 113.58% to be back at the original investment amount – and this took 4 years for the C Fund. Now, consider a hypothetical portfolio that invested 50% in the S&P 500 on July 14, 2000, and 50% in a diversified allocation and had a balance of $7000 on 3/6/09. This is still a loss of $3000 overall, but would only need to grow 42.86% before fully recovering. The difference in the dollar amount might be just $2318 between accounts, but for the bigger loss, 70.72% more growth is needed to regain the original investment amount!

| Beginning Investment (7/14/2000) |

Value on 3/6/2009 | Loss | Return Needed to Recover | |

|---|---|---|---|---|

| S&P 500 (C Fund) | $10,000 | $4,682 | $5318 (-53.18%) | 113.58% |

| Hypothetical Portfolio (50% S&P 500) | $10,000 | $7,000 | $3000 (-30%) | 42.86% |

How Has the C Fund Performed Historically?

Impact of Volatile Market on C Fund Returns

Market volatility can significantly impact the returns of the TSP C Fund, as stock prices fluctuate in response to economic and geopolitical events. During periods of high volatility, the C Fund may experience sharp declines, reflecting broader market trends. However, over the long term, the stock market has historically rebounded from downturns, allowing the C Fund to recover and continue its growth trajectory. Understanding the impact of volatility is crucial for investors who must be prepared for short-term fluctuations in pursuit of long-term gains.

Comparing C Fund Performance with Other Stock Funds

When comparing the average annual return C Fund with other stock funds, such as the S Fund and international stock index funds, it’s essential to consider the differences in their investment strategies and risk profiles. The S Fund, for instance, focuses on small to mid-sized U.S. companies, while international stock funds invest in companies outside the U.S. These differences can lead to varying performance outcomes, with the C Fund often providing more stable returns due to its focus on large-cap stocks. By diversifying across multiple stock funds, investors can mitigate risk and enhance their portfolio’s overall performance.

How Inflation and Interest Rates Impact the C Fund

Inflation and interest rates are critical factors that can impact the performance of the TSP C Fund. Rising inflation can erode the purchasing power of investment returns, while changes in interest rates can affect the cost of borrowing and the valuation of stocks. When interest rates rise, it can lead to higher borrowing costs for companies, potentially impacting their profitability and stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock market performance, benefiting the C Fund.

Invest with Strategies for Diversifying Your TSP Portfolio

Diversification is a key strategy for managing risk and enhancing returns in a TSP portfolio. By investing in a mix of TSP funds, including the C Fund, G Fund, F Fund, and others, participants can spread their risk across different asset classes and market sectors. This approach helps mitigate the impact of poor performance in any single fund and provides a more balanced investment strategy. Investors should consider their risk tolerance, investment horizon, and retirement goals when determining their asset allocation.

Understanding the Role of Lifecycle (L) Funds

Lifecycle (L) Funds are another option for TSP participants looking to simplify their investment strategy. These funds are designed to automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches. By investing in L Funds, participants can benefit from a diversified portfolio that is managed to align with their retirement timeline. This hands-off approach can be particularly appealing for those who prefer not to actively manage their investments.

What Are the Predictions for the C Fund Over the Next 10 Years?

Expert Opinions on Future C Fund Performance

Experts generally have a positive outlook on the future performance of the TSP C Fund, citing the long-term growth potential of the U.S. economy and the resilience of the S&P 500 Index. While short-term volatility is expected, the C Fund is likely to continue benefiting from the strength of the 500 large companies it tracks. However, investors should remain vigilant and consider potential economic and geopolitical challenges that could impact future returns.

Long-term Investment Strategies for TSP Participants

For TSP participants, a long-term investment strategy is essential for achieving retirement goals. This involves maintaining a diversified portfolio, regularly reviewing and adjusting asset allocations, and staying informed about market trends and economic developments. By focusing on long-term growth and remaining disciplined in their investment approach, participants can maximize their chances of achieving a secure and comfortable retirement.

Start planning your retirement at an online federal retirement webinar!

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). We also hold the Accredited Investment Fiduciary (AIF®) designation. At PlanWell, we are federal employee financial advisors with a focus on retirement planning. Learn more about our process designed for the career fed.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars using helpful online training. Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting through our online form.