Federal Retirement Benefits Report

No-Cost Federal Retirement Report | Schedule Now

Benefit Report Designed For Feds

After helping Feds for 20+ years, we have seen a recurring theme: federal retirement planning is complex and confusing. Experts in the area are few and resources are scattered. When it comes time to fill out the Application for Immediate Retirement (SF-3107) federal employees can be left with an unsettling feeling that something has been missed or forgotten.

At PlanWell, our goal is to remove all of the noise and fluff from federal retirement planning. We have found that federal employees are wasting countless hours googling or attending webinars that cover information that is unrelated to their situation. That’s why we created a simple and concise report based on your unique federal service. Come retirement, you deserve to feel confident you made the right choices for you and your family.

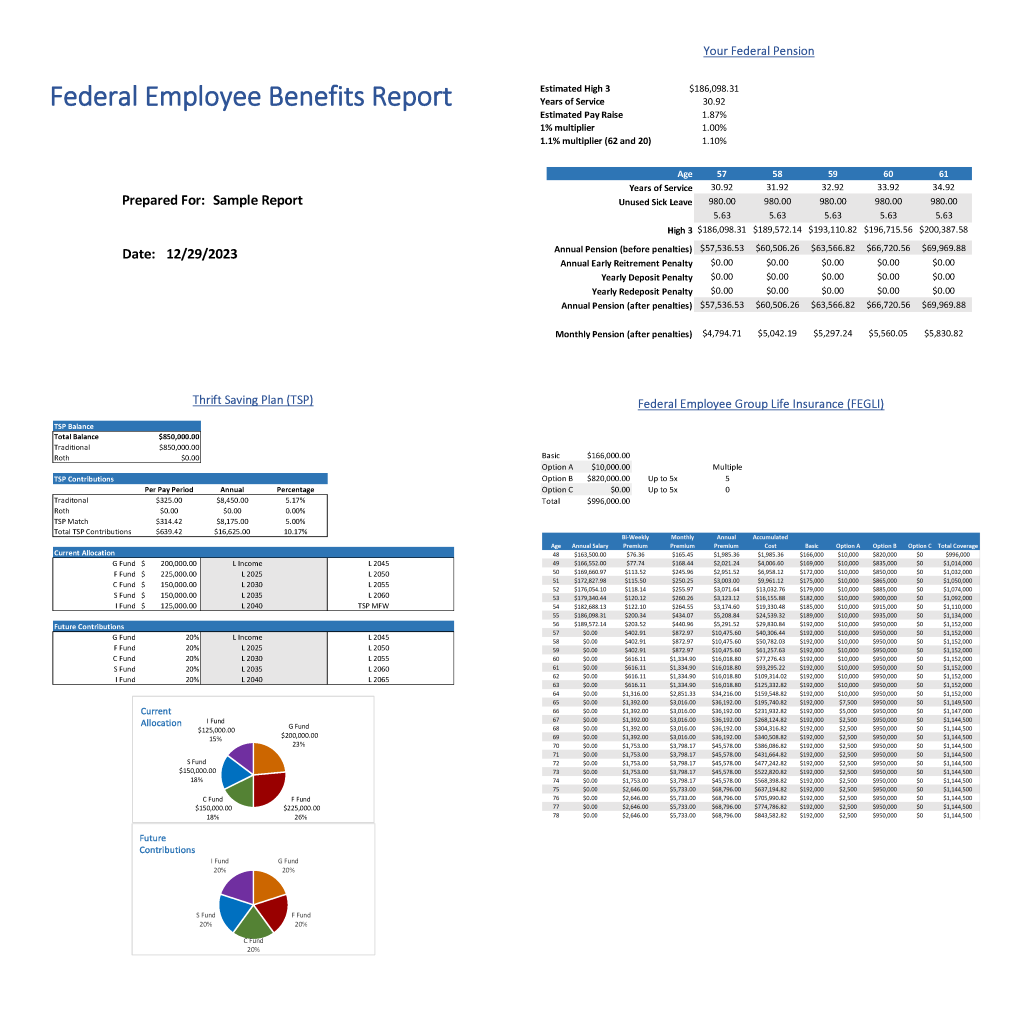

We offer a no-cost and no-obligation Federal Benefits Report that is based on your federal service. Our comprehensive, 22-page report covers everything you need to know in preparation for a federal retirement. At the end of the one-on-one meeting, you get to keep the report.

What the Federal Benefit Report Covers:

- Federal Employee Retirement System (FERS)

- Civil Service Retirement System (CSRS)

- Thrift Savings Plan (TSP)

- Survivor Benefits

- Federal Employees Group Life Insurance (FEGLI)

- Federal Employees Health Benefits (FEHB)

- Medicare

- Social Security

- Sick Leave Conversion

- Annual Leave Payout

- Federal Long-Term Care Insurance Program (FLTCIP)

- List of Action Items

In addition, we provide a list of action items to consider in the short-term, long-term, and when important financial milestones occur.

How Are We Different From the HR Report?

Our team of Chartered Federal Employee Benefit Consultants (ChFEBC) are trained to provide guidance based on your federal service and financial situation. HR is tasked to only provide retirement estimates, how to fill out paperwork, and is instructed not to provide recommendations. We work with you on a personal level by going in depth on topics such as survivor benefit, FEGLI strategy, FEHB integration with Medicare Part B, social security, and Thrift Savings Plan (TSP). We specialize in retirement planning for federal employees.

The Single Resource for Feds

No more sifting through hundreds of pages at OPM or long full-day or even two-day seminars. Often, the information is generic and irrelevant to your situation which can cause more confusion than when you started your self-education journey. That’s why we started the Federal Employees Process. A trusted process to understand ALL of the options and decisions that feds are entitled to. After only two meetings with a Chartered Federal Employee Benefits Consultants (ChFEBC) you will feel confident heading into retirement that you have made the correct decisions for you and your family.

1-on-1 Meeting with a ChFEBC

We want to ensure that this is YOUR time. Feel free to ask the questions that are most important to you! Maybe you are not sure where to start and that’s completely normal. Our experienced ChFEBCs know how to walk you through a trusted process that encourages questions you may not have thought of and highlight items of concern that need to be addressed.

Retirement Planning for Federal Employees – A Process Designed for the Career Federal Employee

Every client-facing Financial Planner for federal employees holds the following designations:

PlanWell’s Financial Planners are thoroughly trained in the CSRS, CSRS-Offset, and FERS systems. At our 1-on-1, we will take into account outside financial factors to be considered when making federal benefit decisions. Elections selcted on the SF-3107 become irrevocable after submission. Often, we see federal employees seek help from a Financial Advisor who is not qualified or lacks the expertise in FERS retirement. As a result, costly mistakes could be made unknowingly for you and your family. Choose a Financial Advisor for federal employees.

Find more information about our credentials and how we differentiate ourselves here: The PlanWell Difference

The PlanWell Process for Federal Employees

Discovery

Introductory meeting with one of our Chartered Federal Employee Benefits Consultants (ChFEBC). Bring your Leave and Earnings (LES), TSP statement, and Social Security summary. We will review a financial questionnaire and help answer any questions that are most important to you.

Federal Benefits Report & Action Items

Review your personal Federal Benefits Report. You get to keep the report.

In addition, we will review your action items. A list of actionable steps based on your specific financial situation. These action items help solve potential gaps in your financial plan. Instead of being given a list of “To Do” items, we use this time as an opportunity to provide education on the why and how.

Partnership

Engage in a partnership with us. We will help assist with completing your action items in the near-term and keep you on track for the long-term.

Contact Us

At PlanWell, we are focused on federal retirement planning for federal employees. If you have additional federal benefit questions, choose a Financial Planner for federal employees. Our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Charter Federal Employee Benefits Consultants (ChFEBC℠) help answer your individual questions. We provide federal retirement planning workshops for federal employees. Federal retirement planning webinars for federal employees, designed just for Feds!

Common Questions We Answer for Feds

- What is the formula for calculating retirement?

- How much is a federal pension after 20 years?

- How many years do you need to retire from the federal government?

- How much survivor benefit should I choose?

- How does unused sick leave affect retirement benefits?

- Is there a cost-of-living adjustment (COLA) for Federal retirees?

- Do you provide retirement planning workshop for federal employees?

- How does the Survivor Benefit Plan (SBP) work?

- Can federal employees work after retirement and still receive benefits?

- How is the High-Three (High-3) calculation used in FERS retirement?

- Are there any special considerations for law enforcement officers (LEO) or firefighters in federal retirement?

- What is a Financial Advisor for federal employees?

- What resources are available for federal employees to plan for retirement?

- How does a VERA or early-out (Voluntary Early Retirement Authority) affect Federal retirement?

- How does a VSIP (Voluntary Separation Incentive Payment) work?

- Does FEHB continue in retirement?

- How much is a federal pension survivor benefit?

- What happens to FEGLI at retirement?

- Do you provide retirement planning webinars for federal employees?

- What is the minimum retirement age (MRA) for federal employees?

- How is the retirement annuity calculated under FERS?

- What is a Financial Planner for federal employees?

- What is the Thrift Savings Plan (TSP), and how does it work?

- How can federal employees maximize their TSP contributions?

- Are there penalties for early retirement under FERS?

- What is the role of the Special Retirement Supplement in FERS retirement? (often confused as social security supplement)

- How does military service impact federal retirement benefits?

- What is the process for applying for federal retirement benefits?

- Can federal employees retire before reaching the minimum retirement age (MRA)?

- How do Thrift Savings Plan (TSP) withdrawals work in retirement?

Federal Retirement Planning for Federal Employees Near Me

Secure your financial future with the expertise of a Financial Advisor for government employees near you. Choose PlanWell Financial Planning in Reston, VA, and benefit from our experienced federal retirement planning specialists. Choose a Financial Advisor for federal employees. Contact us today to embark on your journey toward a secure and prosperous future.

Chartered Federal Employee Benefits Consultant Near Me

Plan your federal retirement with the expertise of a Chartered Federal Employee Benefits Consultant near you. Choose PlanWell Financial Planning in Reston, VA, to site with a Financial Planner for federal employees and benefit from our experienced ChFEBC team. Contact us today to receive your personalized Federal Benefits Report.