ETFs vs. Mutual Funds: Navigating Your Investment Choices

In the vast options of investment, two tools have emerged as popular choices for investors: Mutual Funds and ETFs. Both offer ways for investors to professional management and access to markets that may be readily available for diversification. However, there are some critical differences between them. This overview will delve into the key characteristics, advantages, and considerations associated with both mutual funds and ETFs, providing a foundation for exploring their respective pros and cons in greater detail. By unpacking these differences, we can equip you to make the right choice for your investment journey.

Exploring the World of Mutual Funds

While you may not be familiar with the term, you may already own mutual funds. If you have an employer sponsored retirement plan (401k, 403b or the TSP) the options inside are all mutual funds. A fund is a collective investment pot that pools money from many investors.

The role of a fund manager in actively managed mutual funds

Every fund has a goal or objective it tries to achieve. It is the fund manager’s job to deliver. The fund manager will use the pool of money and invest in what they think is the best way to accomplish the fund’s goals. Moreover, they also have to follow the fund’s guidelines and rules. If the fund goal is investing in U.S. Large Stocks, the fund manager can only buy US large stocks. They cannot buy small company stocks, international stocks, bonds, or anything else. So when picking funds, the most important thing is not performance. It is to understand the fund’s objective and see if it matches your goals.

How mutual funds may offer diversification benefits

When you own a mutual fund, you own a portion of the share pool. That means you can use very little money and invest in thousands of stocks or bonds. The fund’s performance is the average performance of all the underlying investments. Your share price is calculated at the end of each trading day to reflect the total value of what the mutual fund owns.

Buying and selling mutual funds: Understanding the process

Buying and selling mutual funds is very easy. With a 401k or TSP, you only need to enter the changes you want, which take place the next day. In the private sector, you can buy them in an investment brokerage account or open an account with a mutual fund company. It may be advantageous to open a brokerage account so you can easily buy multiple funds from different fund companies within one account.

When you buy a mutual fund, your dollar goes to the fund company, which provides you with shares of the fund. When you sell, you give the shares back to the fund, and they redeem them based on the value at the end of the business day. You can not sell the fund to someone else, and you can only receive the value at the end of the business day.

How Do ETFs (Exchange-Traded Fund) Work and What Makes Them Unique?

An exchange-traded fund (ETF) is very similar to mutual funds in many ways. It is still a fund, so it is still a pool of investor using their money to buy investments. It also has an objective or goal it aims for. Moreover, it has a fund manager that makes sure the fund’s goals are met. The most significant difference is how you buy and sell it when compared to a mutual fund.

Understanding how ETFs trade like stocks on the exchange

Instead of redeeming your shares with the fund, the shares you buy and sell are done on a stock exchange. You can list your shares for your desired price and see if someone else will buy them. And because the stock market is open from 9:30 AM ~ 4:00 PM EST, you could get different pricing throughout the day. A lot of investors like this idea since they can sell at 10 AM and know exactly what price they receive. This is compared to a mutual fund where you can request to redeem your fund at 10 AM, but the exact price of the share is unknown until the end of the business day when all the investments get revalued and calculated.

Why ETFs often offer tax efficiency advantages over mutual funds

Tax efficiency is another reason investors may decide to use an ETF instead of a Mutual Fund. The biggest reason is the redemption process with mutual funds. To generate the cash a mutual fund needs, it has to redeem shares, which means selling investments. All of the tax consequences are passed to all mutual fund shareholders because they all own the shares. This is why you see tax distributions from mutual funds at the end of the year, even when you didn’t sell any funds yourself.

ETFs, on the other hand, are not redeemed. You sell them on the exchange to a buyer. So, if someone else sells their ETF shares, the transaction will not have any tax impact on you. This might make sense if you are in a high tax bracket and would like to minimize capital distributions at the end of the year. Key to note that while gains distributions are less likely from ETFs, they can still happen.

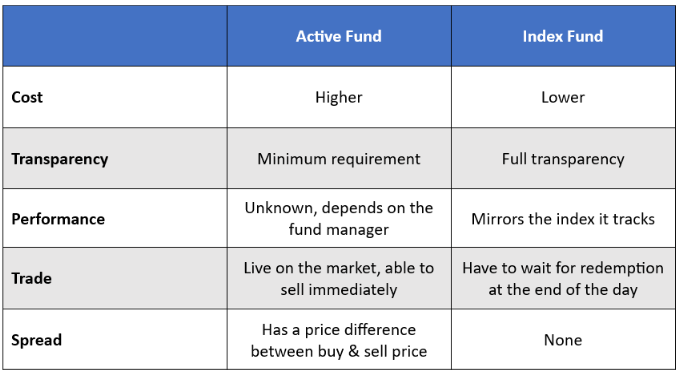

Comparing the management styles: Actively Managed Funds vs. Index Funds

When comparing mutual funds vs. ETFs, one investing concept that creates additional confusion is active investing vs. indexing. Here are the differences and why it matters.

An active fund aims to outperform the market by getting more returns, reducing risk, or both. It will measure itself against a benchmark for performance purposes and compare itself against other funds with similar goals. To help it achieve its goal, the fund would employ a team of managers and analysts and use computer systems to find the best places to invest. That also means the fund’s expenses would be higher, so it can pay for the manpower and computer systems. While the goal is to outperform, the final result depends on the manager’s performance. Performance is not guaranteed. A good example is a US Large Cap Fund. It’s goal would be to outperform the S&P 500.

An index fund doesn’t try to outperform the market. It prides itself on mimicking the performance of a benchmark or index. Because the goal is to mimic rather than outperform, it doesn’t need as many analysts, managers, or systems, so it would have much lower operating expenses. A good example of an index fund would be the TSP C Fund, which uses the S&P500 index as its benchmark, or any other fund that may have the S&P500 index in its name.

How Does Active vs Index Mean for ETFs and Mutual Funds?

Here’s where a lot of confusion comes in. There are active and index mutual funds, just like there are active and index ETFs. The scope of each category matters. In 2022, there were an estimated 6,585 active mutual funds compared to 517 index mutual funds. As for ETFs, it was the exact opposite: There were 939 active ETFs compared to $1,845 index ETFs. That’s why most investors think of mutual funds as active and ETFs as indexes.

Fees and expenses: Why ETFs tend to be less expensive than mutual funds

This is another misnomer. It is not that ETFs are less expensive than Mutual Funds. It is that index funds are less expensive than active funds. And because most ETFs are index funds, the cost is lower. It is important for you to make sure you read the objective to understand its goal so you can better compare costs. Remember that there are actively managed ETFs with higher costs just like there are index mutual funds with lower costs.

Disadvantages of ETFs You Should Consider

The advantage of trading makes ETFs attractive, but it can also be harmful. Because it trades on the market, all tradeable assets have a spread, which is the difference between the buy and sell prices. This spread could be a hidden cost for ETFs as well. For example, when you review an investment on a trading platform, you will see the bid / ask price. The bid is the buy price and the ask is the sell price. The two are never the same. You will always see a higher bid and a lower sell, even if the difference is only 1 cent. The spread or cost can be greater for lesser-traded ETFs. Compared to a mutual fund, there’s no spread, and you always receive the exact value of the underlying investment.

Second, because more people use ETFs to trade, they tend to jump in and out of investments, actively trading indexes. We all know that timing the stock market does not work over time. Lastly, when the market has increased volatility, the spread widens. This only affects ETFs.

Comparing Performance: ETFs vs. Mutual Funds

When it comes to long-term performance, the jury is still out on a clear winner between ETFs and mutual funds. It’s more important to understand that low-cost index funds tend to lead to competitive returns since the market tends to trend upward over time. However, actively managed funds do have the potential for outperforming the market if the fund manager’s stock selections are successful, but most do not outperform over time.

Consider factors like the expense ratio (a key cost difference between actively managed funds and index funds). Lower fees translate to a larger portion of your returns staying invested, and aligning the fund or ETF’s goals with your own risk tolerance and investment horizon is crucial. Once you decide on the index, the performance different tend to be very minor when comparing a mutual fund or ETF.

Which is Right for You: ETF or a Mutual Fund?

The choice between ETFs and mutual funds ultimately boils down to aligning your investment strategy with the strengths of each option. Before diving in, take time to understand your investment goals. Are you seeking capital appreciation, steady income, or a balance of both? ETFs, particularly broad-market ones, offer a low-cost way to achieve long-term growth, while actively managed mutual funds might be a better fit if you’re comfortable with potentially higher returns and fees associated with professional stock picking.

Risk tolerance is another crucial factor. ETFs only mirror one index, which may only consist of a portion of the overall stock market. It would be up to you to build a balanced and diversified portfolio to match your risk tolerance. Mutual funds can offer a mix of investments already picked for a particular risk tolerance all in one fund. This is a more simplified approach for novice investors.

Lastly, remember that it’s not an all or none choice. You are free to use both when building your portfolio. Diversification is key, and both ETFs and mutual funds can play a valuable role in your investment journey.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.