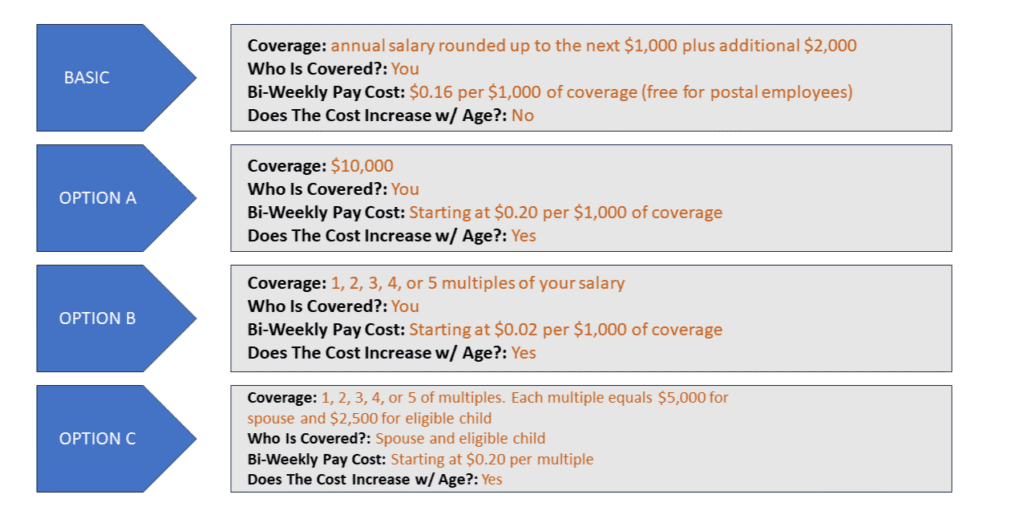

Federal Employee Group Life Insurance (FEGLI) is term life insurance provided by the federal government through a payroll deduction. The cost of Basic insurance is shared between you and the government. You pay 2/3 of the total cost and the government pays 1/3. FEGLI will pay a death benefit in the event you or a family member die.

What Types Of Coverage Does FEGLI Offer?

*Exceptions for Basic coverage = if you are under age 45, you receive an “extra benefit,” if you are under age 35, you receive double your salary, this extra amount decreases each year by 10% each year until age 45

Enrollment and Increasing Coverage

When you first join service, you will are automatically enrolled in FEGLI basic unless you opt out of the coverage. If you want Optional insurance, you must make an election within 60 days of becoming eligible. There are few other opportunities to add or increase coverage after your first day. You must experience one of the following:

- Qualifying Life Event (increase within 60 days)

- Marriage

- Divorce

- Spouse’s death

- Acquisition of a child

- Provide form SF-2822 and pass a physical exam https://www.opm.gov/forms/pdf_fill/sf2822.pdf

- Wait for FEGLI open season

- These are a rare event that does not happen often

- The last two open seasons were in 2016 and 2004

If you wish to enroll in FEGLI, you will need to submit Life Insurance Election form SF-2817 to your Human Resources office. https://www.opm.gov/forms/pdf_fill/sf2817.pdf

Designating a FEGLI Beneficiary

It is important to elect a beneficiary when enrolling in FEGLI. We often see that a beneficiary is chosen when people first join service (often at a young age) and then the beneficiary is never updated. You can update your beneficiaries with the Designation of Beneficiary SF-2823 form. https://www.opm.gov/forms/pdf_fill/sf2823.pdf

FEGLI Calculator

You can calculate the cost of FEGLI through the FEGLI calculator on OPM’s website. The calculator is a great tool to understand how much your bi-weekly pay period cost will be in the present, future, and how your costs can change in retirement. https://www.opm.gov/retirement-center/calculators/fegli-calculator/

If you have any questions about FEGLI, please reach out to us. Every Financial Planner at PlanWell is a Chartered Federal Employee Benefits Consultant (ChFEBC) and well versed in your federal benefits.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.