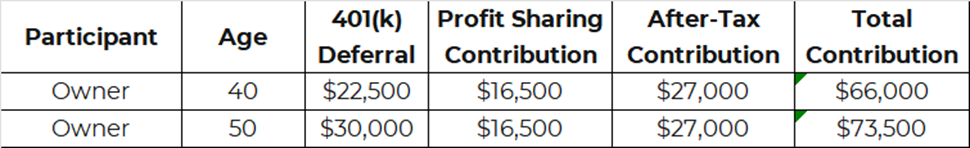

The Mega Roth – $73,500/Year Into a Roth IRA

A mega backdoor Roth is a little-known strategy allowing you to save $73,500 ($66,000 if under 50) into a Roth IRA annually. The mega Roth is primarily used by people with high incomes who cannot contribute to a Roth IRA due to income limitations.

Roth IRA Phaseout Income Limits

Single = $138,000 – $153,000

Married = $218,000 – $228,000

The $73,500 Formula

Formula = 401(k) + Employer Matching/Profit-Sharing + After-Tax Contribution + Roth Conversion

An individual can contribute up to $22,500/year (under 50 years old) or $30,000/year (50+ years old) to a Traditional 401(K) or Roth 401(k).

You can fund the remaining balance of ($73,500 – $30,000) $43,500 through any of the following ways:

- Employer can contribute via matching or profit sharing

- Employee can contribute with after-tax dollars

Backdoor Roth Conversion

You can then convert the traditional and after-tax dollars (past or present) to a Roth IRA. To better understand how a backdoor Roth strategy works, please check out our latest article on Backdoor Roth Contributions here: Unlock the Secret to Tax-Free Retirement Savings with Backdoor Roth Contributions

There are a few requirements for a successful Mega Roth:

- Employer plan must offer after-tax contributions

- Allow in-service withdrawals (not a deal breaker)

After-Tax Contribution with In-Service Withdrawal

You will want to make an after-tax contribution, then immediately take an in-service withdrawal before the after-tax contribution generates returns. It isn’t a deal breaker if your plan doesn’t offer in-service withdrawals. Once you leave your employer, you can conduct the mega backdoor Roth. However, you may owe taxes on the investment earnings once rolled over.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for a federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.