Should Federal Retirees Elect Medicare Part B in Retirement?

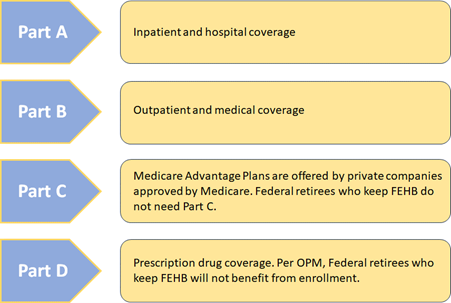

Medicare Part B is not required and can add to the monthly healthcare costs. Does it make sense to take Part B? Do the benefits outweigh the extra cost? We will break down the costs and provide an analysis of the pros and cons. Let’s briefly cover how Medicare works.

What does Part B cover:

- Doctors’ services and tests

- Outpatient hospital services, including observation care

- Limited home health care (must be homebound)

- Durable medical equipment

- Some preventative and screening services

- X-ray and laboratory costs

- Physical and occupational therapy

- Ambulance services

FEHB health plans pay for certain items that Medicare does not cover, including, but not limited to:

- Routine physicals and emergency care outside of the US

- Some preventative services

- Medicare may cover some services and supplies that some FEHB health plans may not cover, including but not limited to:

- Some orthopedic and prosthetic devices

- Durable medical equipment

- Home health care

- Limited chiropractic supplies.

Why Enroll in Medicare Part B?

Peace of mind!

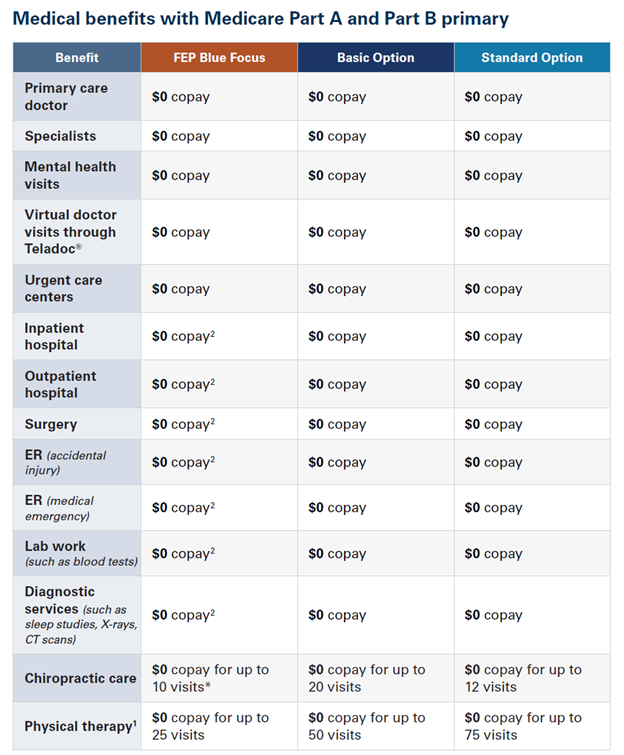

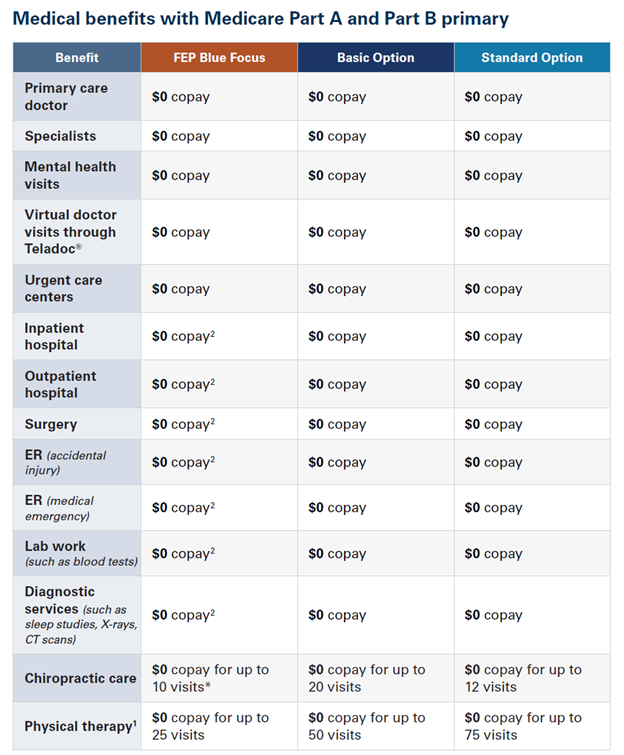

Federal employees will have virtually 100% medical coverage. Having the peace of mind that you will have ZERO or limited medical expenses in retirement is a pretty great deal. That means, no copays, no deductibles, and no co-insurance.

When a Federal retiree enrolls in Medicare Part A and B, Medicare becomes the primary payer of medical expenses. Medicare will pay on average 80% of the medical expenses leaving FEHB to pick up the remaining 20%. In most instances, the Federal retiree will have ZERO out-of-pocket expenses when combining FEHB with Medicare Parts A and B.

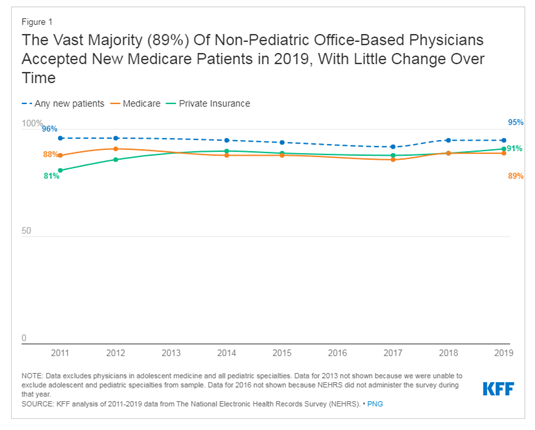

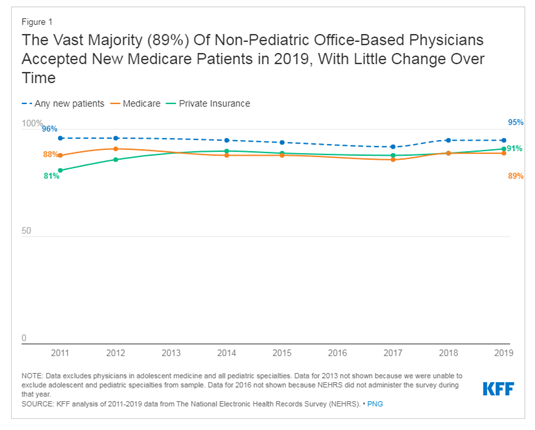

What Percentage of Physicians Take Medicare?

Roughly 89%.

We hear the question asked, “What if my doctor doesn’t take Medicare? Will I have to find a new doctor or specialist?” This would be a drawback to taking Part B if your physician or specialist does not accept Medicare, however more unlikely than not.

According to KFF, between 2011 and 2019 the overall share of non-pediatric office-based physicians accepting new patients was stable and a consistent share accepted new Medicare patients. In 2011 and 2019, 88% and 89% of office-based physicians accepted new Medicare patients, respectively, with modest fluctuations in the years in between. During this same period, the share of physicians accepting new privately insured patients increased from 81% in 2011 to 91% in 2019, becoming more similar to the share that accepted new Medicare patients.

What Would be the Cost Difference?

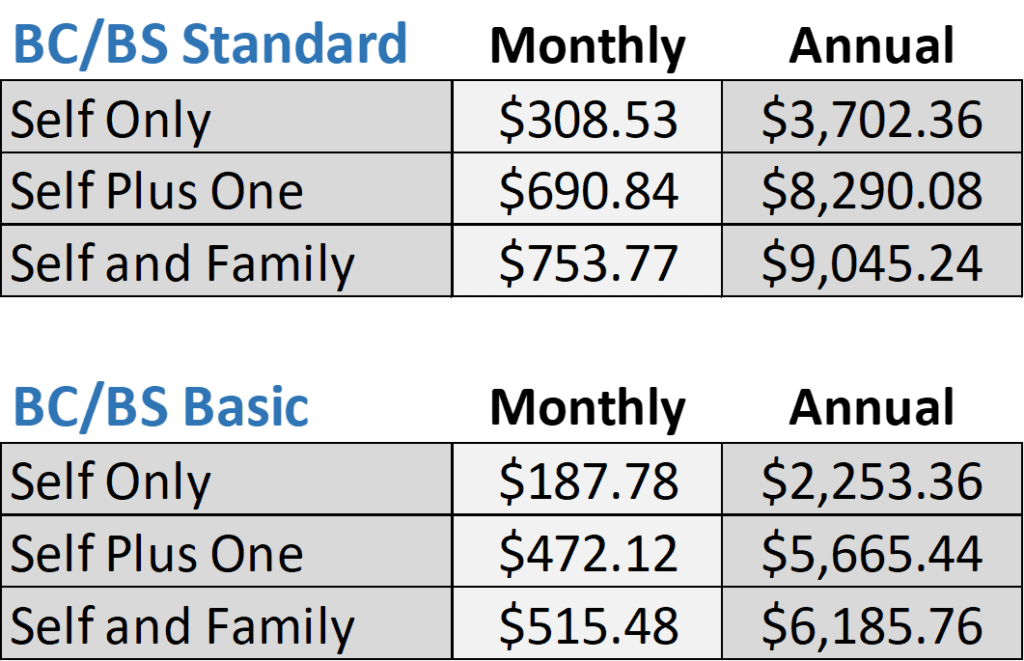

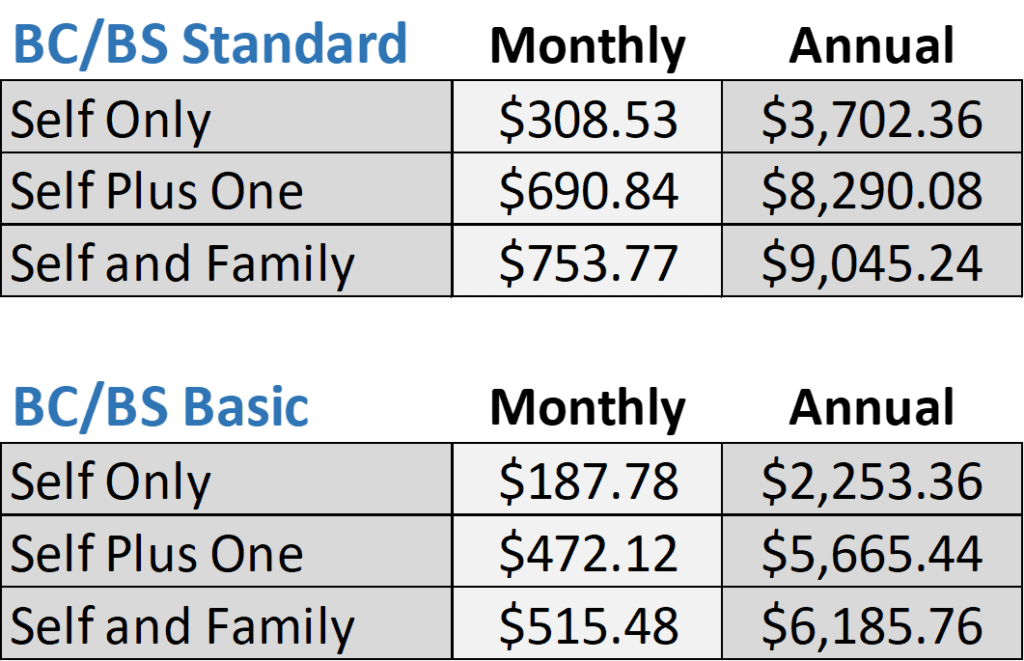

Below we will break down the cost difference of picking up Part B or not. We see most of our Federal clients with BlueCross BlueShield Standard so we will use this as an example.

First off, we want to compare the differences between BC/BS Standard and BC/BS Basic. You would drop down from Standard to Basic if you were to take Medicare Part B. Not only would you receive a decrease in premium cost by switching to Basic, but you are now eligible to participate in the BC/BS Medicare Reimbursement Account. Basic Option members who have Part A and B can get up to $800 with a Medicare Reimbursement Account per person. If married, that would be up to $1,600 back per year that can be used to reduce the monthly cost of Part B.

If you do not have BC/BS, look to see if your health provider offers a similar program. FEHB plan providers want you to pick up Part B since Medicare would become the primary payer. Medicare will pick up the bulk of health expenses, thus why the FEHB plan providers offer incentives for electing Part B.

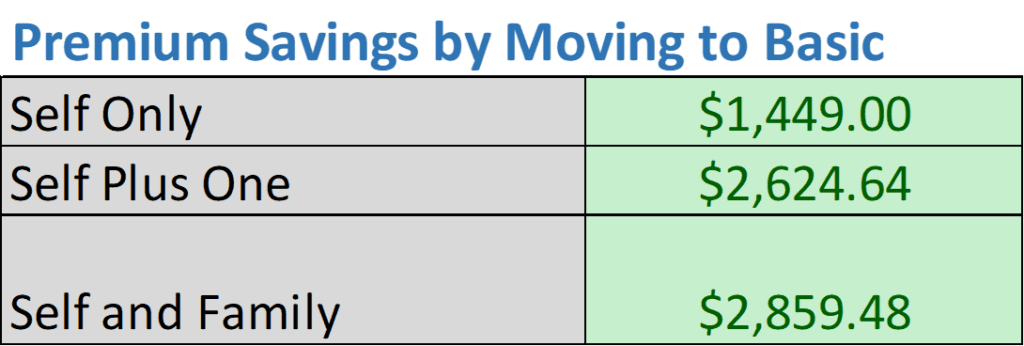

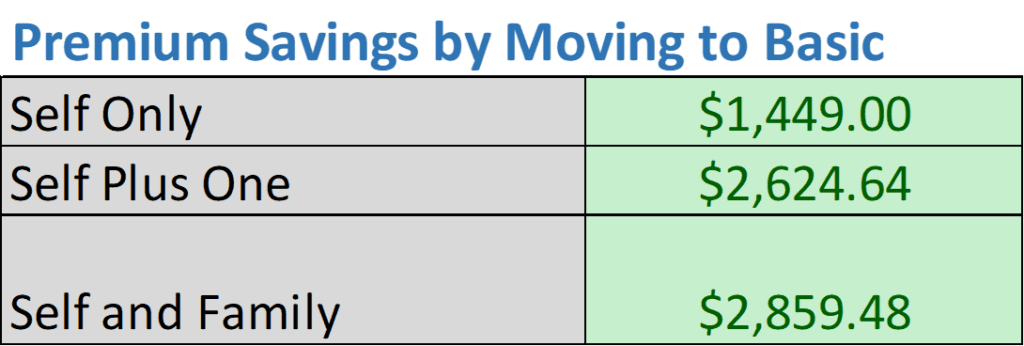

FEHB Premium Savings by Moving From Standard to Basic

For a Federal employee who holds BC/BS Standard Self Only, you would save $1,449.00/annually by switching to BC/BS Basic Self Only (based on 2023 numbers).

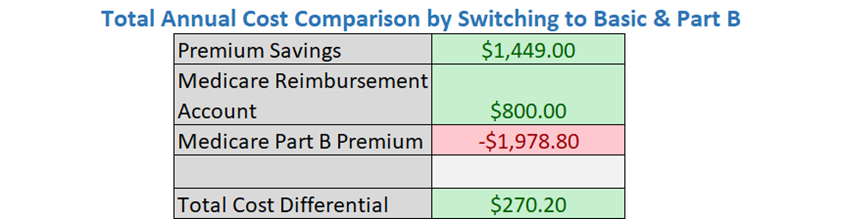

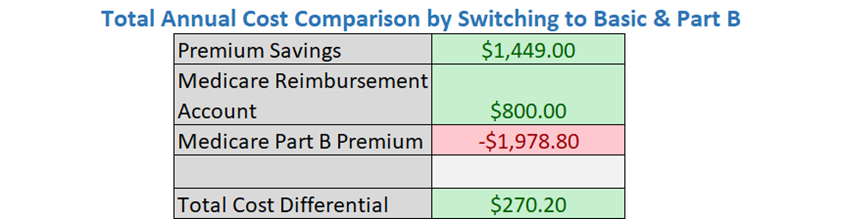

Total Annual Cost Comparison by Switching to BC/BS Basic with Part A & B

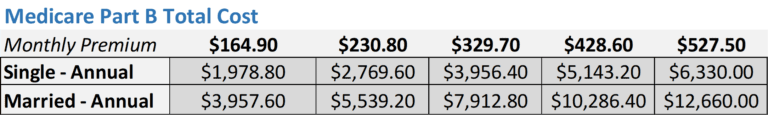

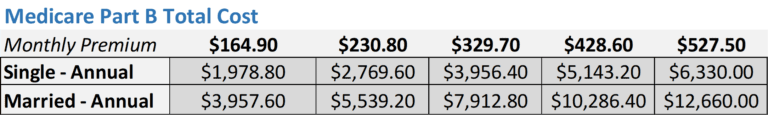

Now, add other savings and costs by switching to Part B. We would assume you would receive $800 from the Medicare Reimbursement Account and, in this example, you would be paying a Part B premium of $164.90/month based on your income.

By switching to BC/BS Basic and picking up Part B you would be saving $270.20 a year.

There Could be Additional Savings Elsewhere

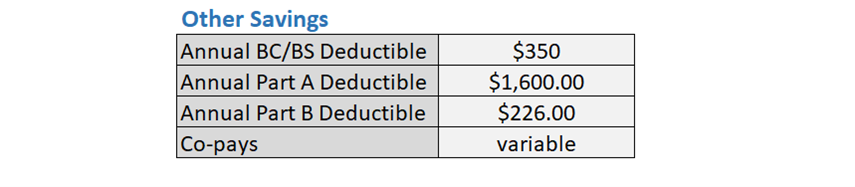

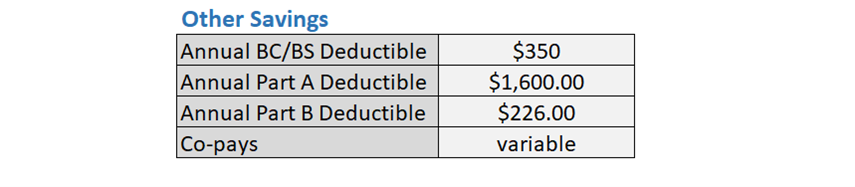

You may avoid paying the deductible for Part A, Part B, and FEHB. Also, there would be virtually no co-pays owed when visiting physicians, specialists, and other benefits.

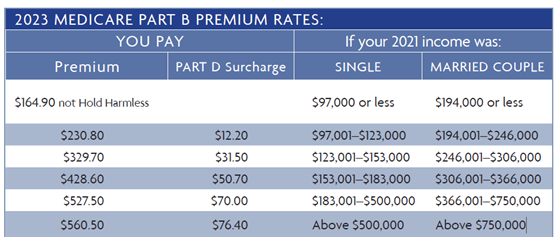

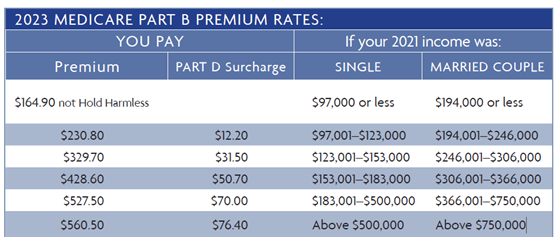

Medicare Part B Premium Chart:

Medicare’s premiums are based on the income-related monthly adjustment amount (IRMAA). IRMAA looks back on income from the prior two years. It may be possible to adjust your IRMAA to today’s income by filling out an IRMAA – Life Changing Event form.

Find the form here: https://www.ssa.gov/forms/ssa-44.pdf

Summary:

Most Federal retirees should be taking Part B. The rise in medical costs has been outgrowing inflation for years. Ensuring you have the extra protection at a relatively small, additional cost makes financial sense.

If you fall into the higher IRMAA premiums, Part B becomes of much less value. You will want to take a closer look at the numbers based on your specific situation and health needs. We would be happy to have a conversation to discuss the pros and cons.

Reach Out to Us!

If you have additional federal benefit questions, contact our team of CERTIFIED FINANCIAL PLANNER™ (CFP®) and Chartered Federal Employee Benefits Consultants (ChFEBC℠). At PlanWell, we focus on retirement planning for federal employees. Learn more about our process designed for the career federal employee.

Preparing for federal retirement? Check out our scheduled federal retirement workshops. Sign up for our no-cost federal retirement webinars here! Make sure to plan ahead and reserve your seat for our FERS webinar, held every three weeks. Want to have PlanWell host a federal retirement seminar for your agency? Reach out, and we’ll collaborate with HR to arrange an on-site FERS seminar.

Want to fast-track your federal retirement plan? Skip the FERS webinar and start a one-on-one conversation with a ChFEBC today. You can schedule a one-on-one meeting here.